Californian software maker Life360 Inc (ASX: 360) is about to reach a milestone.

May will mark its fifth anniversary listed on the ASX.

After a topsy-turvy half-decade as a public company on the Australian exchange, I reckon Life360 shares are priced right to buy at the moment.

Let's explore:

What does Life360 do?

Life360 Inc's bread-and-butter business is its mobile app, also named Life360.

That app is best described as family security software.

It allows parents to track the location of their children, alerts family members if there has been a car accident, provides roadside assistance or emergency services if someone is stranded, and monitors for identity theft.

The smartphone app is most popular in its native country, the United States.

How is the business going?

The company is a typical fast-growing technology stock.

In a business update in November, co-founder and chief executive Chris Hulls revealed that global monthly active users (MAU) had just gone up 24% year-on-year to 58.4 million.

In the iPhone app store, Life360 is ranked #8 in the social networking category, sitting among other popular tools like WhatsApp, Telegram and Facebook.

But the real ace up investors' sleeves is that the business spent much of 2022 and 2023 turning itself from a cash-burning startup to a more mature business that focuses on the bottom line.

While the full 2023 calendar and financial year result will be announced on 1 March, the quarterly numbers already show the reforms are working wonders.

The net loss added up for the first through third quarters in 2023 was around US$25 million. For the whole of 2022, Life360 lost a whopping US$135 million.

Why are Life360 shares such a bargain right now?

The focus on cash flow, the fast-growing user population, and the app's ability to raise prices without losing too much clientele all bode well for the future.

And historically Life360 shares seem to be reasonably cheap at the moment.

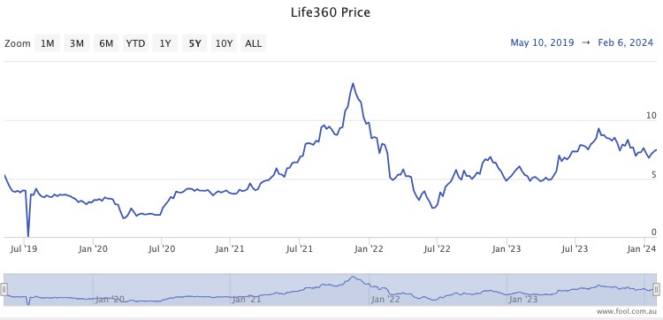

Back in 2019, the initial public offering (IPO) saw shares issued at $4.79. Subsequent excitement about the company rocketed the stock to the high $13s late in 2021.

But after the inflation-induced market selloff, Life360 shares are now hovering in the mid to high $7s.

Professional investors are certainly licking their lips at the prospect of future gains.

Broking platform CMC Invest currently shows five out of six analysts rating Life360 as a strong buy.