The Transurban Group (ASX: TCL) share price is edging higher on Thursday.

Shares in the S&P/ASX 200 Index (ASX: XJO) toll road developer and operator closed yesterday trading for $13.32. In morning trade on Thursday, shares are swapping hands for $13.33, up 0.1%.

For some context, the ASX 200 is up 0.3% at this same time.

This comes following the release of Transurban's half-year financial results for the six months ending 31 December 1H FY 2024.

Here are the highlights.

Transurban share price gains on revenue increase

- Average Daily Traffic (ADT) increased 2.1% year on year to 2.5 million trips

- Proportional toll revenue increased 6.3% from 1H FY 2023 to $1.76 billion

- Proportional earnings before interest, taxes, depreciation and amortisation (EBITDA) came in at $1.33 billion

- Interim unfranked dividend of 30 cents per share, up 13% from the FY 2023 interim dividend

What else happened during the half year?

Transurban noted that the 2.1% increase in traffic over the half year was driven by growth in all its operational regions, along with the opening of new assets.

Sydney's Rozelle Interchange opened to vehicles in November. The company said the opening of the interchange completed the final piece of WestConnex.

The Transurban share price is in the green this morning, with the company noting that it managed to keep its operational cost growth at 1.7%. That ran below inflation, meaning that in real terms costs fell.

As at 31 December, Transurban had around $3.4 billion in corporate liquidity. 94.6% of its debt book was hedged.

What did Transurban management say?

Commenting on the update seeing the Transurban share price in the green today, CEO Michelle Jablko said the solid traffic result "combined with disciplined operational and financial cost management, has underpinned the financial performance seen in the first half of FY24".

Jablko added:

Traffic in Brisbane has continued to grow, well supported by net migration. North America saw improved traffic performance, benefitting from return to office trends. Higher congestion and the time savings offered to our customers resulted in increased average toll prices, further complemented by additional access points opening on the Fredericksburg Extension.

She said that during the half year the company had been working with Google "to provide greater transparency on Google Maps in Australia, further empowering our customers to make informed travel choices".

What's next for Transurban?

Looking at what could impact the Transurban share price in the months ahead, the company maintained its FY 2024 dividend guidance at 62 cents per share. That's up 7% from the full-year payout in FY 2023.

Transurban expects the dividend to include around 4 cents per share from WestConnex cash, which was previously held during construction.

"Longer term, we are well-positioned to deliver disciplined growth through existing opportunities, supporting the significant population growth that is forecast in key markets and emerging mobility trends," Jablko said.

Transurban share price snapshot

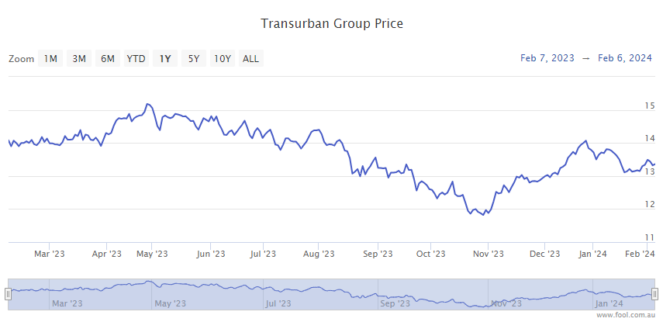

The Transurban share price is down 5% since this time last year.

Shares in the ASX 200 toll road operator are up 13% since the recent lows on 31 October.