The Vanguard Australian Shares Index ETF (ASX: VAS) is today sitting pretty close to a new 52-week high. VAS units are going for $94.16 each at the time of writing. That's less than a dollar away from this exchange-traded fund (ETF)'s current all-time, record high of $95.06 which we saw only earlier this month.

Last week, we covered the S&P/ASX 200 Index (ASX: XJO) hitting a fresh new record high. This, by extension, means that any index fund that covers ASX shares would also be close to, or at, new all-time highs as well.

Even though the Vanguard Australian Shares ETF tracks the S&P/ASX 300 Index (ASX: XKO) rather than the ASX 200, VAS evidently falls into this category.

But these new highs beg the question: Is it worth buying up this ETF today, or should investors wait for a dip? After all, we're all told to 'buy low' and 'sell high'. The present situation seems to fall into the latter scenario.

Should we be buying or selling VAS units on the ASX?

This is a tricky question to tackle. On one hand, buying shares or index funds, at or near record prices increases the risk that returns will be lower in the long run.

We've often seen indexes like the ASX 200 or ASX 300 hit a new all-time high, only to subsequently pull back. That's what happened the last time the ASX 200 hit a new record back in 2021.

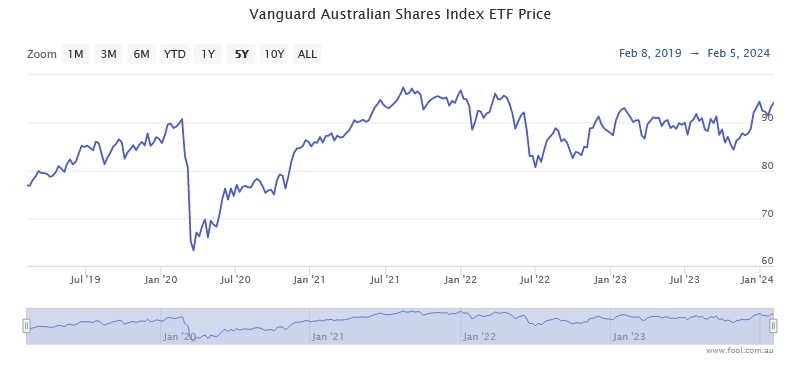

It took more than three years for the index to get back to where it was in August of that year, a fate that the Vanguard Australian Shares ETF has shared, as you can see below:

Saying that, I'm of the belief that if you are an index investor, particularly a passive investor who perhaps employs a dollar-cost averaging strategy to your investing, you should not be put off buying VAS units on the ASX today.

This is due to two reasons. Firstly, history has proved time and time again that trying to time the market by only buying low is a fool's errand. No one knows what an index like the ASX 300 will do tomorrow, next week, next month or next year.

As such, the likelihood of you buying the Vanguard Australian Shares ETF only ever at its most opportune moments is very low. What's more likely is that you'll hold off in the hopes that you can get a better price in the future. If you can't, then you've just missed out.

A better way is to buy periodically and consistently. That way, you never have to worry about what price you're getting, fase in the knowledge that the markets tend to go up over time.

Don't forget about the dividends

Secondly, whilst the VAS ETF's unit prices haven't moved too much between August 2021 and today, it's not like investors haven't been enjoying returns.

As a composite of the majority of the ASX stock market, the Vanguard Australian Shares ETF is a prolific dividend payer. Investors receive a dividend distribution every quarter from this ETF. Since 2021, the annual dividend distribution yield of this index fund has fluctuated between 3% and 7%.

Until recently, that yield alone would have probably netted you more than what you could have received if you'd kept the cash at the bank. Especially considering the franking credits you would have received as well.

So all in all, I think investors shouldn't hold off from buying the Vanguard Australian Shares ETF today if they have the propensity and the cash to do so.