There's no better time to catch a wave than when it's just started.

So here are two S&P/ASX 200 Index (ASX: XJO) buy suggestions from experts that have just started their rally:

'Poised to deliver strong earnings growth'

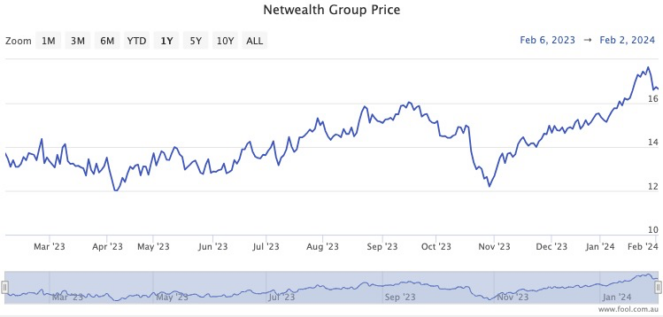

Netwealth Group Ltd (ASX: NWL) shares have been busy climbing 36% since late October.

Sequoia Wealth senior advisor Peter Day still likes the look of them.

"The company's high quality investment platform is poised to deliver strong earnings growth driven by market share gains, in our view," Day told The Bull.

Investors' money is flowing into the investment tool.

"Funds under administration (FUA) stood at $78 billion at December 31, 2023.

"FUA increased by 24.9% for the year to December 31, 2023. FUA net inflows accounted for $9.5 billion and a positive market movement accounted for $6 billion."

Unusually for a fintech, Netwealth shares pay out a dividend, which currently stands at 1.4% yield.

"This wealth management business offers an appealing outlook."

Comeback year for this ASX 200 stock

The Resmed CDI (ASX: RMD) share price has been coming back hard after it fell off a cliff last reporting season.

Fears about the impact of GLP-1 weight loss drugs such as Ozempic sent the ASX 200 stock to a trough in late September, but it has soared 38% since.

Catapult Wealth portfolio manager Tim Haselum acknowledged that obesity is "a contributing factor" towards sleep apnoea, which ResMed's devices treat.

ResMed, with its latest update, dispelled the scares from last year.

"In the second quarter of fiscal year 2024, the company grew revenue by 11% on a constant currency basis compared to the prior corresponding period," said Haselum.

"We expect the sleep apnoea business to grow moving forward."

According to CMC Invest, 18 out of 25 analysts rate the healthcare stock as a buy, just like Haselum.