It has been a very rewarding time to be an ASX share investor over the last several months. Several market sectors have seen gains to the point where some companies may have become too expensive. But I think there are still some great share market buying opportunities.

As a general rule, we don't want to invest when a particular company is trading at a euphoric price. However, it's also worth keeping in mind that solid businesses that are growing have a good chance of delivering appealing capital returns over time – don't give up on a good business just because its share price is higher today than in October 2023.

Shares in the two ASX stocks below have already enjoyed significant lifts, and I think they can keep rising over the long term.

Pacific Current Group Ltd (ASX: PAC)

Pacific Current describes itself as a "global multi-boutique asset management business committed to partnering with exceptional investment managers". The ASX share combines capital, offering uniquely-tailored economic structures, with strategic business development to help businesses grow.

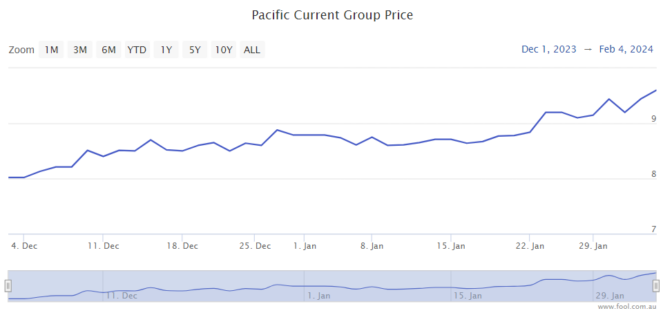

Since 1 December 2023, the Pacific Current share price is up 21%. But I don't think this is going to be the all-time peak.

Its biggest investment is in the fund manager GQG Partners Ltd (ASX: GQG), which is growing funds under management (FUM) strongly and paying large dividends to Pacific Current.

Other fund managers include Astarte, Avante, Banner Oak, Carlisle, Cordillera, Pennybacker, Proterra and Victory Park.

Growth of Pacific Current's FUM can lead to rising management fees. The improving investment environment is good news for natural FUM growth, and I think investors are more likely to want to put new money into fund managers' hands.

In the three months to December 2023, Pacific advised that its aggregate FUM rose 5.6% in Australian dollar terms. Excluding GQG, FUM increased 4.5% for US dollar-denominated fund managers.

Pacific Current's ownership-adjusted FUM – adjusted for how much it owns of each business – rose from US$14.3 billion to US$15.3 billion.

In that quarterly update, the ASX share said its boutiques had made "strong progress" towards its projection of between A$2 billion to A$5 billion of gross new commitments, excluding GQG, in FY24, with A$2.6 billion of commitments already secured in the first half.

Xero Ltd (ASX: XRO)

I think Xero is one of the strongest ASX tech shares and an exciting ASX growth share.

It's already a very large ASX share, but the accounting software company has a lot more profit growth to come, in my opinion.

Over the last decade, it has been investing heavily for long-term growth. It's now letting its profit margins improve while still investing a very healthy amount for more growth.

Xero's underlying profitability could come shining through in the next few results, I'm expecting big increases in percentage terms of the net profit after tax (NPAT) and cash flow.

The HY24 result showed operating revenue growth of 21% to NZ$800 million, and the adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) grew a lot quicker – it increased 65% to NZ$204.5 million.

With the ASX share's gross profit margin now sitting at 87.5%, ongoing subscriber growth and an increasing average revenue per user (ARPU), I think there's a great chance of further longer-term price growth and potential Xero share price gains, despite the 39% rise over the last 12 months.