When many Australians read of passive income, they picture a wealthy celebrity lying on a banana lounge drinking cocktails while royalty cheques fly into their account.

But the fact is that earning money for nothing is well within the reach of ordinary Aussies.

It just requires careful research, ASX dividend shares, compounding, and patience.

It doesn't require any special talent that is uniquely possessed by the chosen few.

Let's explore some hypotheticals:

Aim for 10% each year

ASX investors are fortunate enough to have franking rules that incentivise capital returns via fat dividends, because not every developed country has such a mechanism.

This means that there are quality stocks available that provide very comfortable dividend yields to fast-track you to passive income.

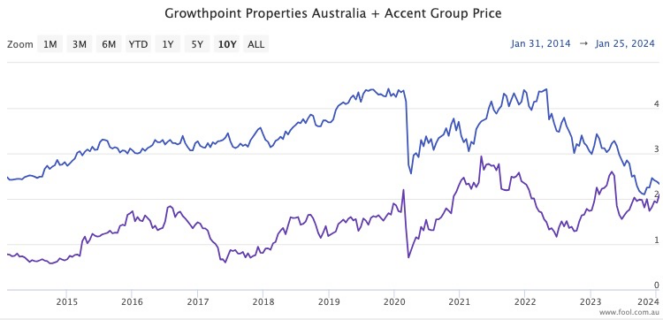

Take Woodside Energy Group Ltd (ASX: WDS), Growthpoint Properties Australia Ltd (ASX: GOZ), and Accent Group Ltd (ASX: AX1) for example.

Playing in the energy, real estate, and retail sectors, they are a well diversified bunch that pay out excellent yields — respectively 10.9% fully franked, 8.9% unfranked, and 8.25% fully franked.

All three are well managed businesses in their fields that command the respect of many professional investors.

CMC Invest shows that 7 out of 12, three of five, and five of 11 analysts rate Woodside, Growthpoint and Accent shares as buys right now.

Combined with franking credits and capital growth, it is not out of the question for a portfolio of such dividend stocks to be collecting 10% compound annual growth rate (CAGR) in the long run.

Reinvest early for rewards later

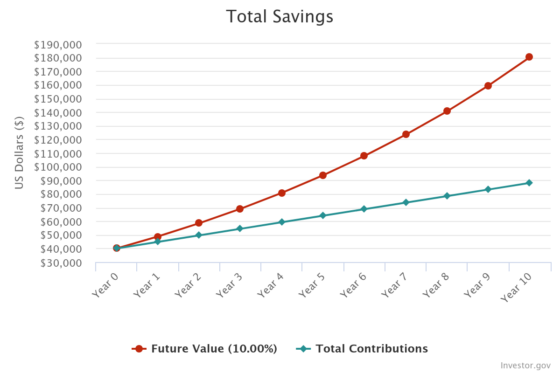

For argument's sake, let's say you can start with a portfolio worth $40,000, which comparison site Finder found last year is the average savings level for Australians.

Then you add $100 each week — or, rounded down, $400 each month.

Initially, every time dividends are paid out, reinvest it straight back into the portfolio. If some of the stocks have dividend reinvestment plans (DRPs), then even better.

If this nest egg can keep up 10% CAGR for 10 years, you'll end up with $180,249 of dividend stocks.

From then on, stop reinvesting the dividends.

Instead, put it in your pocket as your new source of passive income.

That's $18,000 landing in your account each year, or $1,500 monthly.

You can then lie on a banana lounge drinking cocktails.