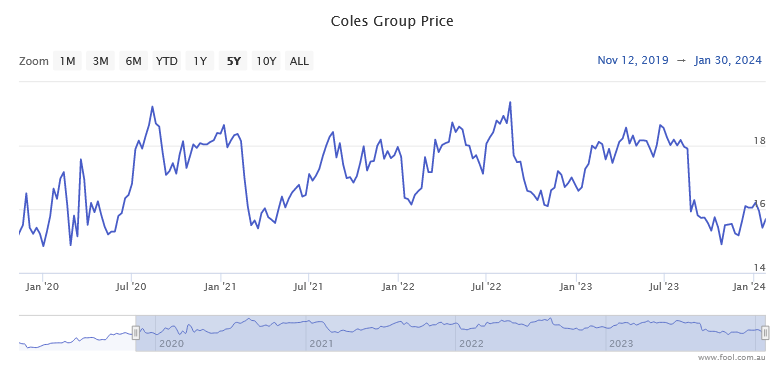

Looking at Coles Group Ltd (ASX: COL) shares, and investors might not grasp just how little they've managed to squeeze out of this ASX 200 consumer staples stock in recent years.

Coles shares have always been a bouncy investment. Over the past 12 months alone, the grocery and supermarket giant has fluctuated between $14.82 and $18.85 a share. That's a difference worth more than 20%.

But at today's share price of $15.74 (at the time of writing), one thing is painfully evident: Coles shares have gone nowhere over the past four years.

Yes, Coles was also going for around this same share price way back in November of 2019. So if you bought Coles shares back then, you've only had the company's dividend to keep you warm at night.

See for yourself below:

Not that Coles' dividend has been insubstantial. Investors have long enjoyed a dividend yield of just over 4% from the supermarket operator. That yield has always come fully franked as well.

But the fact remains that Coles has functioned as more of a term deposit over the past four years than a successful, compounding stock market investment.

Rubbing salt in the wound, shares of Coles' arch-rival Woolworths Group Ltd (ASX: WOW) have enjoyed capital growth of around 10% over the same period.

So perhaps Coles investors are hoping that 2024 is the year that the company goes from loser to winner.

Can Coles shares turn it around in 2024?

Well, the good news is that while the Coles share price has been stagnant over the past four years or so, the company has still been growing. In its 2019 earnings report, Coles posted total group revenue of $38.18 billion, with an earnings before interest and tax (EBIT) of $1.47 billion.

Fast forward to the company's full-year earnings for FY2023 from August last year, and we can see that group sales had increased to $41.47 billion, with an EBIT of $1.97 billion.

This should give investors some comfort as we head into 2024.

But let's see what an ASX expert is predicting when it comes to Coles shares this year.

Just yesterday, my Fool colleague James covered the views of ASX broker Citi on Coles shares.

ASX broker names Coles as a buy

Citi indeed believes that Coles shares are going to have a great year in 2024. The broker has given Coles a 12-month share price target of $17.50 a share, alongside a buy rating. If realised, this would see the Coles share price gain approximately 11% from where the company sits today.

Citi is taking a long view of Coles. The broker reckons the grocer will struggle to grow its earnings over FY2024. However, it is also anticipating Coles will be able to bank solid earnings growth over both FY2025 and FY2026.

That in turn, according to Citi, will see the company increase its dividends substantially over those financial years as well, resulting in an annual dividend of 70 cents per share over FY2025. If Citi is on the money here, it could see Coles shares with a forward dividend yield of 4.45% today.

So that's what one ASX expert has in mind for Coles this year. But we'll have to wait and see whether the market does decide to yank the supermarket operator out of its four-year slump in 2024. No doubt investors have their fingers crossed.