Rural Funds Group (ASX: RFF) is an excellent S&P/ASX 300 Index (ASX: XKO) agriculture stock that provides pleasing cash flow. It's my favourite way to invest in Australian farmland.

Despite the huge amount of land dedicated to farming in Australia, there are few ways to get exposure to farmland on the ASX. Of the companies that do own farmland, many of them are producers, which comes with plenty of operational risks.

There are four main reasons why I like this real estate investment trust (REIT) rather than owning farms myself.

Diversification

If I invested $1 million in a farm, I'd end up with a singular asset in one location – not very diversified at all.

Instead, I could invest a lot less into this ASX 300 stock and get a lot more diversification.

Rural Funds invests in many different farms spread across five different sectors, being cattle, almonds, macadamias, vineyards and cropping.

The risks are spread across different types of farms, in different states and in different climactic conditions. Rural Funds also owns a large amount of water entitlements which can be leased to tenants to ensure they have enough water for their requirements.

I like the diversification that this listed investment gives us. It's also very easy to buy and sell shares through an online broker, whereas buying and selling a farm requires more time, effort and transaction costs.

Passive investment

Owning a farm (and leasing it out) can take a lot of management, such as paying invoices, choosing tenants, sorting out debt financing and ensuring the farm is managed in a sustainable way for the long term.

There are probably plenty of other requirements, but I'm not a farmer or a farm manager. Indeed, that's exactly why owning Rural Funds is so easy – the management takes care of everything. I just need to own the Rural Funds shares and enjoy the passive income rolling in, paid by the rental profits.

Strong yield from the ASX 300 stock

Rural Funds had a long-term weighted average lease expiry (WALE) of 13.9 years, which gives it plenty of income visibility for the years ahead. The strong rental income, combined with growth from a mix of lease indexation mechanisms and market rent reviews, enables the REIT to pay a pleasing distribution yield.

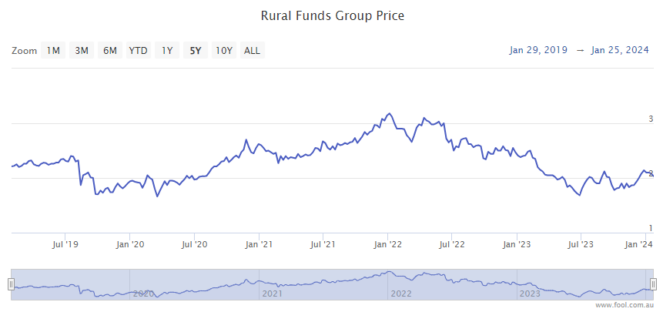

In FY24, the ASX 300 stock is expecting to pay a distribution per unit of 11.73 cents, translating into a forward distribution yield of 5.75% at the current Rural Funds share price.

Capital management

Due to its size, Rural Funds is able to get better financing terms than an individual can. It's beneficial to have expertise in managing all the debt and choosing the right loan.

I particularly appreciate that Rural Funds tries to make its capital work as hard as it can by investing in farms to help grow their productivity, rental potential and capital value.

For example, it has invested in irrigation and water access at some locations. It's also willing to change the farm to produce a different type of food if it means getting much more revenue from that farm. It's currently working on major macadamia developments.