You may have missed the boat, but checking out ASX shares that have exploded is still a fun activity.

As well as providing fantasy stimuli, such stars demonstrate to investors that just one or two stocks can carry a properly diversified portfolio, even if its cohorts had shockers.

So the moral of the lesson is that not every stock you buy has to be a winner for you to end up a winner.

3.7 million patients seeking a solution

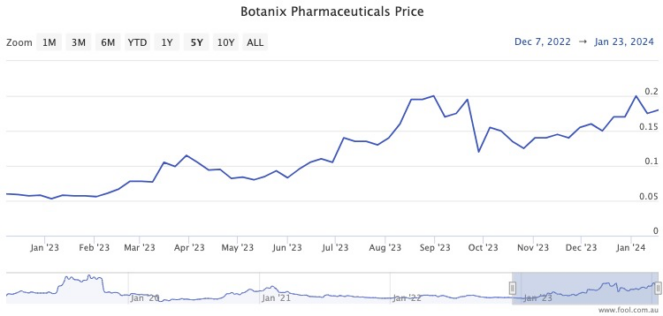

At the close of trade on 30 December 2022, the Botanix Pharmaceuticals Ltd (ASX: BOT) share price sat at just 5.3 cents.

Let's imagine you had the foresight to buy $40,000 of Botanix shares at this time.

During 2023, investors flocked to the ASX healthcare stock as its products went through the development and approval pipeline.

Although formerly known as a cannabis stock, the flagship drug for Botanix is now a substance called Sofpironium Bromide — or Sofdra, as it is commercially known.

As The Motley Fool's James Mickleborow explained last year, Sofpironium Bromide was the first-ever treatment developed to treat primary axillary hyperhidrosis.

That disorder is best described as uncontrollable sweating, especially in the underarms.

"In the US alone, there are approximately 10 million patients who suffer from primary axillary hyperhidrosis. Approximately 3.7 million of those are already actively seeking treatment."

This product was apparently the source of much excitement for investors.

Next catalyst could come in June

Just between June and September, Botanix shares rocketed 150% higher, prompting a "speeding ticket" enquiry from the ASX.

The company explained that it could be investors speculating on the result of an application for Sofpironium Bromide to the Drug and Food Administration (FDA) in the US.

"The company notes that if [the] FDA decision is received, it will represent a significant milestone for the company, as it will pave the way for an expansion of the company's operations and revenue generation."

Unfortunately, in September, the FDA replied to Botanix without an approval, sending the shares crashing down.

The ASX healthcare stock has since recovered, after the company later resubmitted its application.

This week the FDA indicated that it now considered Botanix's application as a "full response" and that an approval decision is scheduled for late June.

So after that rollercoaster ride, the stock price is at 17 cents. That means your investment has now turned into a whopping $128,301.

That's a phenomenal 220% gain in just over a year.

Botanix shares are sparsely covered but, according to CMC Invest, the analysts at Euroz Hartleys rate it as a strong buy.