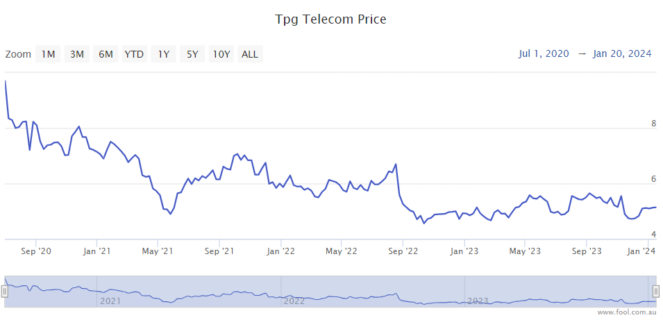

TPG Telecom Ltd (ASX: TPG) shares are down 40% from July 2020 and have dropped 22% from August 2022. Are investors underlying this ASX telco share?

This company is responsible for a number of brands including TPG, Vodafone, iiNet, AAPT and others. All these businesses came together after a merger between TPG and Vodafone Australia.

There are a few good factors about the business to keep in mind.

A growing dividend

TPG has grown its annual dividend each year since 2021 when the merged company started paying cash to shareholders.

We can't control what the TPG share price does, but receiving a growing dividend can offset some of that market uncertainty and share price volatility.

The last 12 months of dividends amount to 18 cents per share, which is a grossed-up dividend yield of around 5%.

TPG's annual dividend per share in 2024 could be 18.8 cents, which would be a grossed-up dividend yield of 5.2%, according to Commsec. The annual dividend per share could then grow to 20 cents per share in FY25 and 21.4 cents per share in FY26.

For investors that focus on dividends, it looks like an appealing option.

Rising prices and subscribers to help profitability?

Vodafone has recently increased prices, though it reportedly only applies to new customers.

In the first half of FY23, TPG reported that its postpaid average revenue per user (ARPU) rose to $44.6 – this was an increase of 6.2% year over year and a rise of 4.4% half over half. However, the prepaid ARPU dropped to $18.9, which was a year-over-year decline of 2.5% and a drop of 1.6% half-on-half.

Subscriber numbers continue to increase, which I believe helps its underlying profitability. Postpaid subscribers rose 5,000 in the six months of the FY23 first half to 3.23 million and increased 2.2% year over year.

Total prepaid subscribers rose 35,000 half over half and went up 167,000 year over year to 2.07 million.

TPG's fixed costs are essentially, you guessed it, fixed. So, an increase in revenue can help increase the underlying profitability of the business. In HY23, service revenue rose 4.5% to $2.3 billion and the earnings before interest, tax, depreciation and amortisation (EBITDA) grew quicker, going up 12.4% to $941 million. Stronger profit is supportive for the TPG share price.

Profitability can also rise from the company's 'simplification' efforts, which it's expecting to achieve $140 million per annum of cash benefits.

Investing for growth

The business is putting a lot of money towards capital expenditure, which will hopefully unlock additional earnings in the coming years. Growing the capabilities of its 5G network is also a key focus.

With 5G, TPG's brands (particularly Vodafone) can offer Aussies a 5G-powered wireless home broadband option. NBN currently takes a lot of the broadband margin, but Vodafone customers using 5G wireless broadband would mean TPG gets a lot more margin.

Investing in 5G is important because it will make sure TPG and Vodafone are keeping up with competition.

Foolish takeaway

Things are looking promising for TPG, but it's not exactly delivering growth that's shooting the lights out. I think it could be a solid ASX dividend share, but it's not cheap.

According to Commsec, the TPG share price is valued at 31 times FY24's estimated earnings and 27 times FY25's estimated earnings.