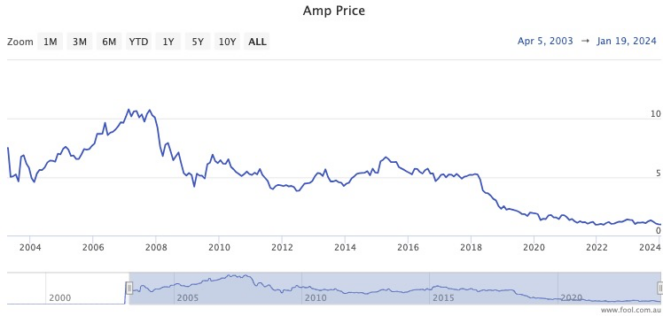

Is there a more maligned S&P/ASX 200 Index (ASX: XJO) stock this century than AMP Ltd (ASX: AMP)?

The financial services provider, especially in the past half-dozen years, has lurched from one scandal to another.

There were unfavourable findings from the financial industry Royal Commission, legal action from multiple parties, and the retention of an executive accused of sexual harassment, just to name a few of the bad memories.

The market has responded accordingly, sending the AMP share price plunging more than 80% since February 2018. The stock now trades in the mid-90 cent zone.

Due to all these troubles, the leadership at AMP is occupied by different faces to what it was just five years ago.

So can investors look forward to a turnaround in 2014, or will AMP shares set a new all-time low?

Not much love for AMP shares, even at this price

Probably the biggest observation to make for AMP shares is that hardly any fund manager or analyst talks about it these days.

It seems very few professional portfolios have the stock on their books.

AMP has always had a disproportionately high number of retail investors. That's because when it demutualised and listed on the ASX in 1998, all previous customer-owners received shares.

Nevertheless, it's not a great sign when no professional investor is willing to give an ASX 200 stock a run, even as a contrarian play.

This aversion is reflected on CMC Invest, which surveys the sentiment of analysts that keep an eye on AMP.

Currently, there is only one out of 10 experts rating the stock as a buy, and even that's a low-conviction "moderate" buy.

The rest are either urging sell or hold.

How low can it go?

So how bearish is the market on AMP?

Will it crash to just 80 cents this year, which would mark a new all-time low?

It could get close.

In November, UBS Group AG (SWX: UBSG) analysts downgraded its target price for AMP shares to just 82 cents.

At about the same time, the team at Citigroup Inc (NYSE: C) reduced its 12-month expectations to 90 cents, which is not far off the mark already.