The S&P/ASX 200 Index (ASX: XJO) experienced much volatility in 2023 due to fears over the impact of high inflation and interest rates. It eventually came good and delivered an 8.1% gain by 31 December.

In this article, we look at the performance of three of the top 15 ASX 200 shares by market capitalisation.

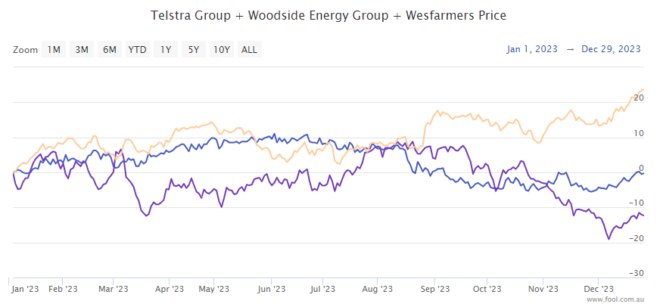

On the basis of share price movement, did Telstra Group Ltd (ASX: TLS), Woodside Energy Group Ltd (ASX: WDS) or Wesfarmers Ltd (ASX: WES) shares have a better year in 2023?

On share price movement, Wesfarmers shares win

As the chart below shows, Wesfarmers shares delivered superior gains last year.

The Wesfarmers share price rose by 24.2% to close 2023 at $57.04. Yesterday, the Wesfarmers share price was trading for $57.17 at the close.

Telstra shares fell 0.75% to close 2023 at $3.96. The Telstra share price finished the week trading at $3.97.

The Woodside share price fell by 12.4% to close 2023 at $31.06. Woodside shares were trading for $30.91 at Friday's close.

On dividends, Woodside shares win… or do they?

In 2023, Woodside shares delivered a $2.15 interim dividend in April. The ASX 200 energy share paid a $1.24 final dividend in September for a total annual dividend of $3.49 plus full franking credits.

Wesfarmers shares paid an interim dividend of 88 cents in March. They paid a final dividend of $1.03 in October. That's a total annual dividend of $1.91 fully franked.

Telstra shares paid an interim dividend of 8.5 cents in March and a final dividend of 8.5 cents in September. This totalled 17 cents in annual dividends, fully franked.

So, in dollar value terms, Woodside shares win.

But what about yield terms?

Heck, yes, they win! By a mile, in fact.

The trailing Woodside dividend yield is currently a staggering 11.24%.

Telstra shares are on a trailing dividend yield of 4.28%.

Wesfarmers shares are paying a trailing dividend yield of 3.24%.

As always, a trailing dividend yield like Woodside's is cause for alarm bells. After all, the average ASX 200 stock delivers a yield of 4%.

Plus, Woodside is an oil and gas company, which means it's a 'price-taker' stock. That means commodity prices for gas and oil have a fundamental impact on the company's earnings, and hence, dividends.

We took a peek at the consensus analyst forecast for Woodside's dividend in 2024, as published today on CommSec, and it is much lower than the $3.49 paid in 2023.

The forecast dividend is $1.77, which equates to a still healthy yield of 5.74%.