How would I invest to create passive income?

I personally am a fan of ASX growth shares, so would try to construct a well diversified portfolio of those stocks.

I reckon putting in just $300 a month could eventually land you a perpetual passive income that averages out to $22,000 each year.

Imagine what you could do with $22,000 extra every 12 months in addition to your day job.

It can go a long way into paying off the mortgage, fund the children's education, or buying a luxurious international holiday with your loved ones.

Let's check out hypothetically how this can be done:

3 growth shares that look great to me

Comparison site Finder last year found the average Australian has around $40,000 saved up.

So let's start with that.

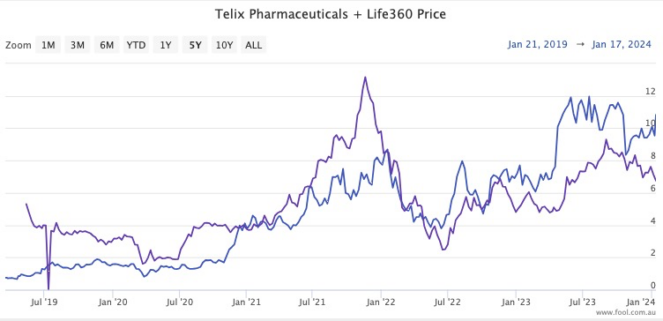

I want to diversify the growth stocks I buy, so I would perhaps choose a range like Life360 Inc (ASX: 360), Telix Pharmaceuticals Ltd (ASX: TLX) and Block Inc CDI (ASX: SQ2).

That's one software maker, one pharmaceutical, and one fintech.

All three are well favoured by professionals at the moment.

Seven out of eight analysts covering Life360 rate the tech stock as a buy, according to CMC Invest. All seven that study Telix recommend it as a buy, while all three professionals that have evaluated Block reckon it's an add.

Now, the past should never be taken as a sign of what's to come in the future. But to demonstrate just how viable it is to generate decent passive income, let's take a look at their returns.

Life360 has been on the bourse for just four months shy of five years, and the stock has climbed 34% in that time. Telix has been sensational over that half-decade, soaring an amazing 1,392%.

Block Inc, since its listing on the ASX in January 2022, has been a disaster, trading 43% lower.

Assuming a full five-year period, Life360's compound annual growth rate (CAGR) calculates to be 6%. Telix was a sensational 71.7%.

A decade of patience, then turn on the passive income

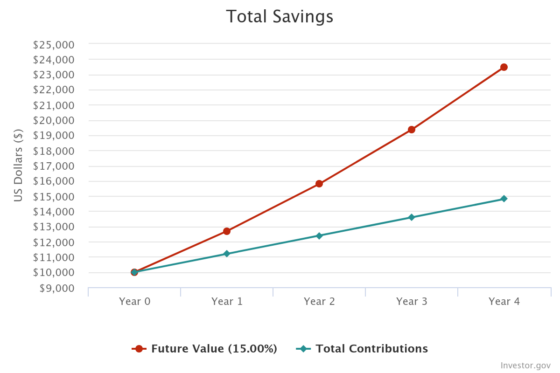

With a diversified mixture of sectors, geographies and stock performance, perhaps you could manage a CAGR of 12% with that $40,000 portfolio.

If you are disciplined with your saving and can thus add $300 each month, the growth will very much accelerate to the promised land.

After 10 years, the portfolio will have fattened up to $187,409.

From then on, the 12% return each year can be sold off to provide passive income.

That's an average of $22,489 cash coming your way annually, as long as you maintain that stock portfolio.

Ten years. That's all you need.