Just one grand could be the start of something special.

It sounds corny, but it's true with the magic of ASX shares and compounding.

Maybe it's a reflection on the state of numeracy in the general population, but many Australians are walking around without realising how a million bucks could be within reach.

Let's check out how one could achieve this with one particular S&P/ASX 200 Index (ASX: XJO) stock as an example:

ASX 200 outfit cleaning up its act

Fintech Block Inc CDI (ASX: SQ2) might be a US$40 billion giant, but it's been making some huge changes in the way it operates.

The previously profligate startup is cleaning up its expenses and focusing on cash flow. And the market is sitting up and taking notice.

"Block Inc outperformed in December following the release of its 3Q23 result the month prior, which exceeded investor expectations with respect to future cost discipline, and strong messaging about internal personnel productivity," read a memo to clients from ECP analysts.

"The result is an expectation of faster operating leverage to emerge across business units, with a plan to hit Block's 'rule of 40' in 2026."

Indeed the Block share price has rocketed 61.8% since the start of November.

Block Inc shares, however, have pulled back 13.7% so far this year with the market volatility caused by the uncertainty of how soon interest rate cuts might come.

Despite this, according to CMC Invest, all three analysts that cover the ASX 200 stock still reckon it's a strong buy.

And this buying opportunity means you can now pick up 10 Block shares with your $1,000.

Let's make a million

Past is never an indicator of future performance, but checking out the track record of Block shares gives us an idea of what's realistic for that $1,000 to achieve.

The ASX 200 stock only listed in 2022, so for long term history we need to examine the original US version, Block Inc (NYSE: SQ).

That has returned 402% since listing in November 2015.

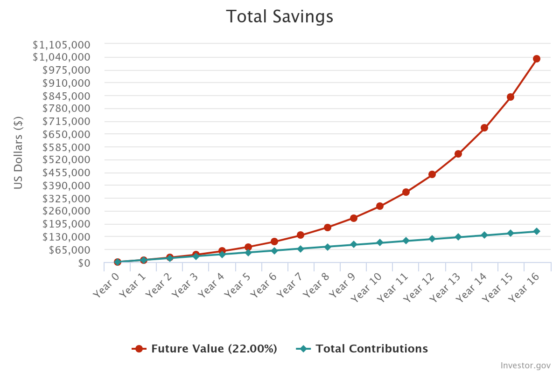

If we round those figures to a 400% gain over eight years, the compound annual growth rate (CAGR) works out to be 22.3%.

That's not a bad result at all, considering that period has seen multiple market corrections, such as the 2018 correction, the 2020 COVID-19 crash, and the 2022 inflation crisis.

So if your $1,000 of Block shares can grow at 22% each year, and you can chip in $800 a further each month, you're on your way.

After 16 years at that rate, your investment will have grown to $1,031,456.

There's your million.

If you can start when you are 35 years old, you will have reached seven figures at 51, which is not a bad age to retire at.