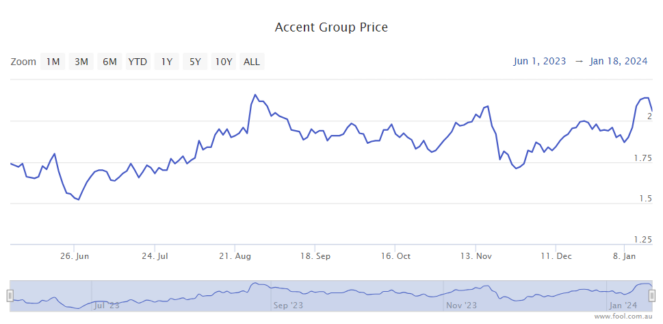

The Accent Group Ltd (ASX: AX1) share price has done very well over the last several months, as we can see on the chart below.

Accent is one of the largest shoe retailers in Australia, it acts as the distributor for a number of different global brands including Vans, Ugg, Kappa, Hoka, Skechers, Dr Martens and CAT. The business owns a number of brands in Australia including The Athlete's Foot, Glue Store, Nude Lucy, Stylerunner and Trybe.

Strong returns by the Accent share price

The ASX retail share has seen a rise of around 33% since the low in June 2023, which is a very strong return considering the S&P/ASX 200 Index (ASX: XJO) only went up by 3.8% over the same time period. That means the business has outperformed by around 30% in about seven months.

I wouldn't expect the next several months to show that level of outperformance again because that's not usually how things go – past performance is not a reliable indicator of future returns, particularly in the shorter term.

With a $1,000 investment, it would have turned into $1,330. A $3,000 investment would have turned into approximately $4,000. A $5,000 investment making a 33% return would become $6,660.

On top of that, the business has paid a dividend which boosted the return. The company paid a dividend per share of 5.5 cents a few months ago. That added an extra 3.6% of a return, which is a return of over 36%.

Can the ASX retail share keep rising?

Anything can happen on the ASX in the shorter term.

In the middle of last year, the Accent share price was suffering from an investor weakness as investors didn't know how long the high inflation and interest rates were going to stay.

To me, it's understandable that some investor confidence has returned with inflation reducing and interest rates look to have seemingly peaked.

2024 may see some weak trading conditions with households suffering amid a higher cost of living and high interest rates. But, if interest rates start to come down, we could see household budgets improving and spending more on retail, including shoes.

The company can grow its profit in a number of ways in the future: increase its number of stores, grow its digital sales, add additional brands to its portfolio or take its own brands overseas.

By doing these things, the profit could keep rising and this can help the Accent share price.