After a terrible couple of years, more than one pundit is predicting ASX small-cap shares will play catch-up in 2024.

The portfolio managers at Cyan Investment Management reckon some of those businesses are now in better shape than when the stock market started abandoning small caps at the end of 2022.

"We believe those companies that have taken this challenging period to reduce costs to right-size their businesses and focused on cash flow and balance sheet management will be best placed for the year ahead," the Cyan team said in a memo to clients.

"These are the types of business we have been focusing on and believe the portfolio is well positioned."

Here are two stocks in particular that Cyan is bullish on, that have already started to creep upwards:

'Quality of work and diversified business model'

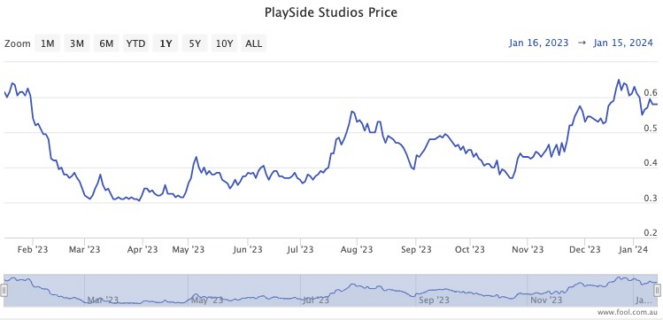

Cyan has backed Playside Studios Ltd (ASX: PLY) pretty much since its listing at the end of 2020, and the analysts are excited about the current state of the business.

"In recent months, Playside has delivered strong cash flow performance and upgraded its already solid revenue guidance for FY24 to $55 to $60 million.

"This momentum continued in December when it announced it has signed an agreement with Warner Bros Discovery Inc (NASDAQ: WBD) Interactive Entertainment for a multi-game licence to use 'highly recognisable intellectual property' under licence for the development of two PC/console titles."

Indeed on that news the share price pushed 17% higher during the month.

"There was no financial detail, but it is assumed to be a material opportunity," read the Cyan memo.

"We see this as further validation of the quality of work and diversified business model."

The Cyan team has unanimous support among their peers.

According to CMC Invest, all three analysts covering the stock currently rate Playside as a buy.

Bad news now priced in for this small cap

Silk Logistics Holdings Ltd (ASX: SLH) also had a great December, rising 7%.

But the shares still trade almost 28% down from its peak in February last year.

"Other than general financial market weakness, the company has faced headwinds in some areas as the economic activity has slowed across verticals such [as] consumer discretionary spending," read the Cyan memo.

"SLH enjoyed some respite in December rallying to $1.85, even though there was no clear catalyst by way of any company announcements."

Despite expected weakness in performance for the December half, the Cyan analysts believe that is already reflected in the current valuation.

"We see it as priced-in and believe the company offers outstanding value and income (P/E <8, yield +5%) with strong growth in the years ahead."

The stock is sparsely covered by other professionals. But CMC Invest shows at least Morgans and Shaw & Partners agreeing with Cyan, with both rating Playside shares as a strong buy.