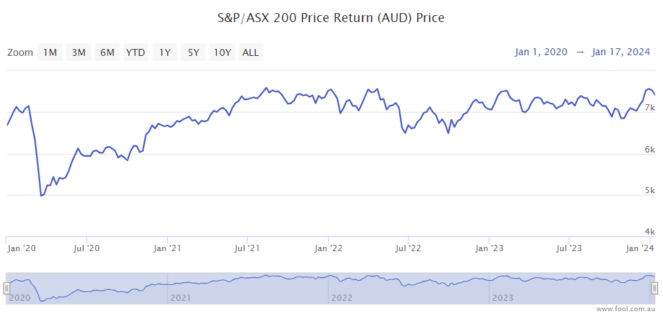

The S&P/ASX 200 Index (ASX: XJO) has risen 9% since 31 October 2023, and it's fairly close to its all-time high. Could this be a good time to invest in ASX 200 shares to get rich?

Once-in-a-decade opportunity?

It's common for the share market to go through volatility. There are no rules about when share prices are going to go up and down.

The share market has seen several moments of heavy declines in the last few years such as the COVID-19 crash in 2020, the inflation-caused decline in 2022 when interest rates started rising, and another interest rate-induced decline in October 2023.

So, it wouldn't be true to think the share market can only decline once a decade.

It's true that the ASX 200 was a lot cheaper a few months ago and even lower in 2022 and 2020. So, we can't call the current ASX 200 valuation the best time to invest.

But, it wouldn't surprise if ASX 200 shares fell again at some point in 2024. Partly because the market does regularly (but unpredictably) fall, and partly because it has risen strongly in recent times. That's interesting considering interest rates haven't actually started falling yet, and may not decline in the US or Australia for many months still. The market may have gotten ahead of itself, but we'll have to wait and see what happens.

Can the ASX 200 help us get rich?

There are a few different ways to invest in 200 of the biggest businesses on the ASX, even if they're not exactly tracking the ASX 200.

iShares Core S&P/ASX 200 ETF (ASX: IOZ) and SPDR S&P/ASX 200 (ASX: STW) are two of the most obvious exchange-traded funds (ETFs) that track the index.

Other good ways to get exposure to the same sorts of ASX 200 shares include the BetaShares Australia 200 ETF (ASX: A200) and the Vanguard Australian Shares Index ETF (ASX: VAS).

We can regularly invest in these sorts of ASX ETFs without worrying about the valuation too much.

The last decade of returns from the ASX 200 hasn't exactly shot the lights out, it has been overshadowed by the global share market where there has been more growth.

But, if the ASX 200 is able to deliver annual returns per annum of around 9% to 10%, then investors can see their portfolio values double in less than ten years, which is an attractive wealth growth rate. $100 becomes $259 in ten years if it's growing at 10% per annum, though no one knows what future returns are going to be.

In other words, I think ASX 200 shares can always help us become wealthier. But, when the share market is noticeably down, it can be a good idea to considering invest more.

For me, there are individual ASX 200 shares that may be able to deliver much stronger returns than the ASX 200.

I like to regularly write about the names I see as opportunities. With individual names, I always think there are stocks at valuations that can help us become richer over time.