Rising interest rates were a headwind for ASX real estate investment trusts (REITs) last year, and today they look like good value, says Morgan Stanley Australia's co-head of investment banking, Tim Church.

Before we get into why, let's take a look at the recent performance of ASX REITs.

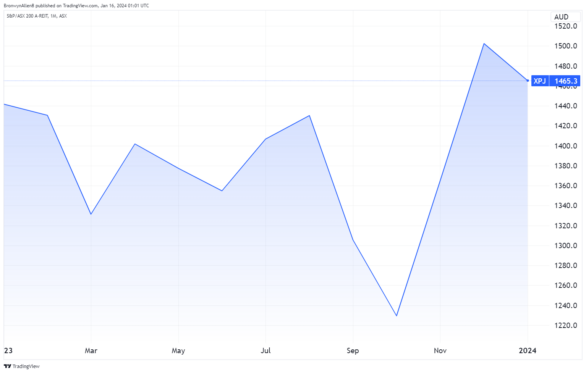

ASX REITs smashed in 2023, but recover strongly in Santa Rally

The S&P/ASX 200 A-REIT Index (ASX: XPJ) hit its 2023 trough of 1,216.6 points on 30 October.

At that time, the property shares index was down 8.76% in the year to date compared to a 3.78% fall in the benchmark S&P/ASX 200 Index (ASX: XJO).

Everything changed in November, with the traditional Santa Rally starting early as yields on long-dated bonds fell and optimism that the US Federal Reserve would cut interest rates in the new year grew.

The chart below shows this change. As you can see, ASX REITs had a massive rally in November and December, with the A-REIT Index rising 23.5% over this two-month period.

ASX REITS looking 'decidedly good value'

Tim Church told the Australian Financial Review (AFR) that ASX REITs are looking like bargains.

Church said:

Bombed-out REITs that have suffered from a combination of poor sentiment and rising bond yields and cash rate increases look decidedly good value, ie oversold, particularly when you consider that we are closer to – if not there already – peak interest rates.

In an AFR roundtable discussion, Church and other real estate investment bankers noted that more property funds were likely to downgrade their commercial property valuations this year.

Valuations are likely to fall most on office tower assets amid hybrid working arrangements reducing demand for office space post-pandemic.

More of these valuation downgrades may take place during the February reporting period.

Which REITs are good buys?

Here's how the top three ASX REITs by market capitalisation stack up based on consensus ratings published on CommSec today.

Goodman Group (ASX: GMG)

The biggest REIT, Goodman Group, is trading at $24.29 per share on Tuesday. The consensus rating on CommSec is a moderate buy. The rating fell from a strong buy on 27 November.

Scentre Group (ASX: SCG)

The Scentre Group is changing hands at $2.93 per share today. The consensus rating on CommSec is a moderate buy. The rating increased from a hold on 5 June.

Stockland Corporation Ltd (ASX: SGP)

Stockland shares are trading at $4.43 per share today. The consensus rating is a moderate buy, up from a hold rating on 2 June.

Median home values rose by 8.1% in 2023 while ASX REITs booked a 12.67% gain for the year overall.