All businesses have their ups and downs but, if you can look past the short-term bumps, brilliant opportunities to pick up some cheap shares can come up.

The team at QVG Capital reckons this is exactly the case right now with IDP Education Ltd (ASX: IEL).

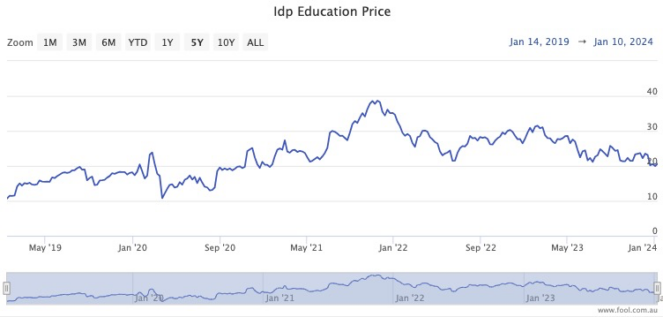

In a boom month for the Australian month, the share price for the language testing and international student service provider painfully plunged 11.6% in December.

"We believe IDP is an excellent business with strong long-term growth prospects and competitive advantages," stated a QVG memo to clients.

"Despite this, the stock has performed poorly over 2022 and 2023."

Cheap shares with 'excellent opportunity for high future returns'

IDP shares have been a favourite among professional investors ever since COVID-19 hit, because of the expected recovery in international student activity.

But the stock has failed to live up to expectations, losing almost half its value since November 2021.

In recent times, the IDP share price has plummeted more than 36% since last February.

The QVG analysts understand why the market has been put off.

"A change in CEO, competition in their last monopoly English language testing market in Canada and housing shortages causing risk to international student numbers conspired to send the stock down by a quarter in 2023."

But, for them, this has now sent IDP shares into bargain territory because the long term drivers for the business are still there.

"The stock now trades on the lowest valuation [it] has since listing in 2015," read the memo.

"If our analysis of IDP's slowing growth – that it's cyclical not structural – is correct, then the current retreat in its share price presents an excellent opportunity for high future returns."

Indeed many of their peers agree that IDP is a tempting add right now.

According to CMC Invest, seven out of 10 analysts that cover the ASX 200 stock currently rate it as a buy.

For the QVG team, IDP shares still match their investment philosophy.

"Our goal is to find companies with growing earnings that can surprise to the upside.

"We continue to believe in a more muted earnings environment these will remain rare and valuable."