Australian investors have the great fortune of having world-class dividend stocks readily available to them.

That's because of the favourable tax rules that incentivise publicly listed companies to return capital via dividends to investors.

The dominance of the mining and banking industries helps too.

However, I want to talk to you about how powerful investing in ASX growth shares can be.

There is a perception among many investors that the best growth opportunities are in places like the United States.

But there are plenty of excellent choices in our own country if you're willing to give them a go through a long investment horizon.

I reckon turning $10,000 into $15,000 in a reasonable amount of time using these stocks is not out of the question.

Check this out:

Three popular ASX growth shares

As everyone says, past performance gives no clues as to what the future holds for any given stock.

But let's examine the history of three growth stocks that have put plenty of smiles on the faces of their investors over the last half-decade.

Logistics software maker WiseTech Global Ltd (ASX: WTC) is an outstanding Australian success story.

Those shares have returned more than 280% over the past five years, which includes such market trauma as COVID-19 and inflation-induced 2022 correction.

Real estate classifieds provider REA Group Ltd (ASX: REA) has also performed admirably over that time, gaining more than 150%.

A much smaller ASX growth stock, TechnologyOne Ltd (ASX: TNE), has appreciated a very respectable 138% in the past five years.

The Brisbane company provides software and services to business clientele.

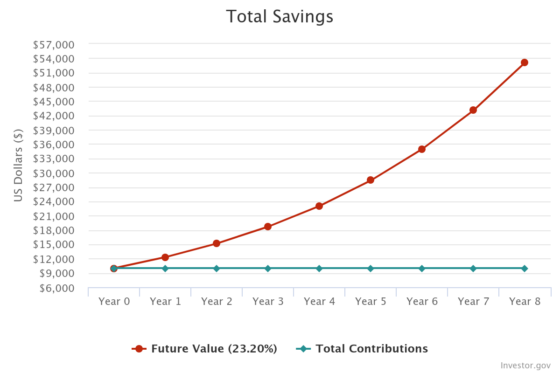

Those three stocks, respectively, have delivered compound annual growth rates (CAGR) of 30.6%, 20.1% and 18.9%.

That averages out to 23.2%.

So if you had $10,000 and you bought equally into those three stocks, it would take just eight years for that to grow into $50,000.

That's without any additional investments along the way.

You can see now that ASX growth stocks can compete capably against the best of their overseas counterparts.

Good luck with your investments.