Do you think you could turn $40,000 into a never-ending pot that will provide you $36,000 of passive income each year?

Sounds pretty crazy, but it's not that far-fetched.

Consider this hypothetical:

Diversify to even out sector fortunes

There are many ways to invest for passive income, but I personally prefer ASX growth shares.

As well as the potential to outperform, I find it more qualitatively satisfying to watch these businesses expand and mature to bigger and better things.

Let's take a look at these growth stocks that many professionals are recommending as buys at the moment: Lovisa Holdings Ltd (ASX: LOV), Mader Group Ltd (ASX: MAD) and Avita Medical Inc (ASX: AVH).

Firstly, they are diversified in the industries they play in: retail, mining services and healthcare.

Diversification is crucial so that the risk of your portfolio completely tanking is managed. The idea is that if one sector is suffering from economic conditions, the others could make up for it.

Diversify for performance

Secondly, they are all growing businesses with bright futures.

Of course, past performance is not an indicator of the future. But the track records of these stocks give us an idea into how a growth portfolio could multiply your $40,000.

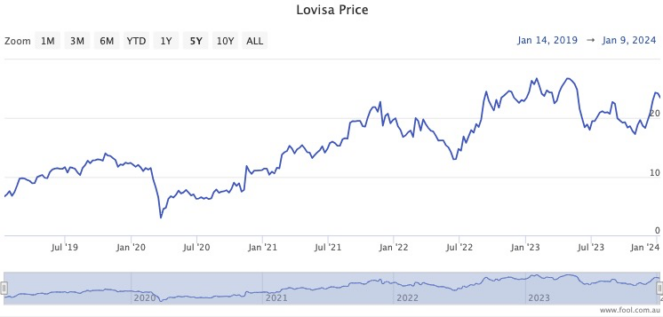

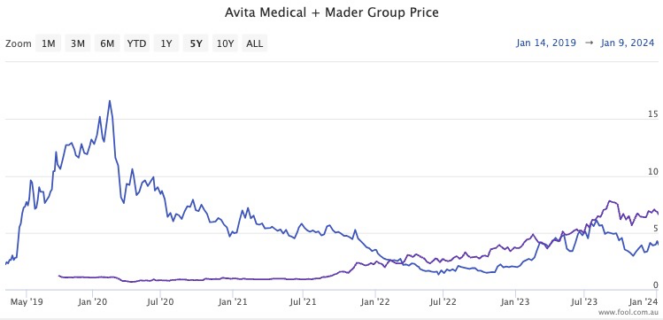

Over the past five years, the Lovisa share price has rocketed 247%. The Mader Group, since listing four years and three months ago, has seen its stock soar 492%.

That makes Avita Medical's five-year gain of 109% seem pretty tame, although that's excellent in itself.

Those figures equate to compound annual growth rates (CAGR) of 28.3, 52% and 15.9%.

Sure, there is no way in hell you will pick an entire portfolio of such huge winners.

But, again, with proper diversification you might end up with a few of these alongside some duds.

With prudent management, perhaps you can manage a portfolio-wide CAGR of 12%.

Turn your savings into a passive income machine

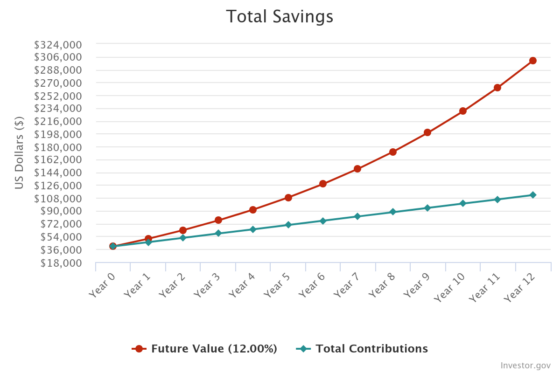

Returning to that $40,000, say you have the patience to let that grow for 12 years at 12% per annum while adding $500 each month along the way.

The stock portfolio will have then grown to more than $300,000.

From that point on, sell off the 12% gains each year to receive your passive income.

That will provide you $36,000 of cash every 12 months without you having to work for it.

How good is that!

Of course, some years the payout will be much lower than that amount and sometimes there will be no income at all.

But over the long run, with the help of some windfall years, the passive income could average out to $36,000.

Mission accomplished.