Fund manager Wilson Asset Management (WAM) has named two leading ASX healthcare shares that could be strong growth opportunities.

WAM runs a number of listed investment companies (LICs) that look for growing businesses where there is a catalyst to send the share price higher.

The investment team have noted two ASX stocks from the WAM Capital Limited (ASX: WAM) portfolio in the healthcare space that could be good ideas to own.

Sigma Healthcare Ltd (ASX: SIG)

Sigma is an Australian wholesale and distribution company that supplies community pharmacies. But, it may soon be a very different business.

Last month, Sigma announced a merger with Chemist Warehouse Group to create a leading healthcare wholesaler, distributor and retail pharmacy franchisor.

The company expects the proposed merger to achieve cost synergies of approximately $60 million per annum, with the merged business having a possible market capitalisation of $8.8 billion.

Sigma Healthcare also announced a capital raising of around $400 million. This will fund the Chemist Warehouse supply contract and further growth initiatives.

WAM explained its main reason to like the ASX healthcare share:

We believe the proposed merger will provide Sigma Healthcare with significant growth opportunities and we look forward to the transformation the transaction will make to the company.

Over the past year, the Sigma Healthcare share price has lifted 61%.

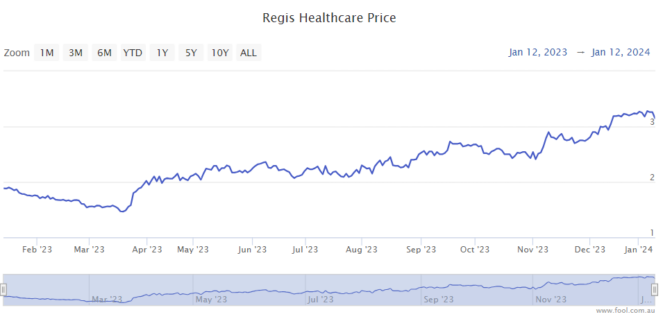

Regis Healthcare Ltd (ASX: REG)

Regis Healthcare is one of Australia's largest aged care providers.

In December, the company announced it completed the acquisition of CPSM, a privately-owned residential aged care provider, for $74.2 million. Regis expects the acquisition to add to earnings per share (EPS) in FY24, with further growth expected in future years.

The CPSM deal resulted in Regis Healthcare acquiring CPSM's five "high-quality" residential aged care homes in South East Queensland with 644 beds. This deal will boost the ASX healthcare share's portfolio to 68 homes with 7,604 beds.

WAM included its thoughts by saying:

We believe the company's inorganic strategy to acquire complementary aged care assets will continue to drive earnings over the next few years.

Over the past year, the Regis Healthcare share price has risen around 70%.