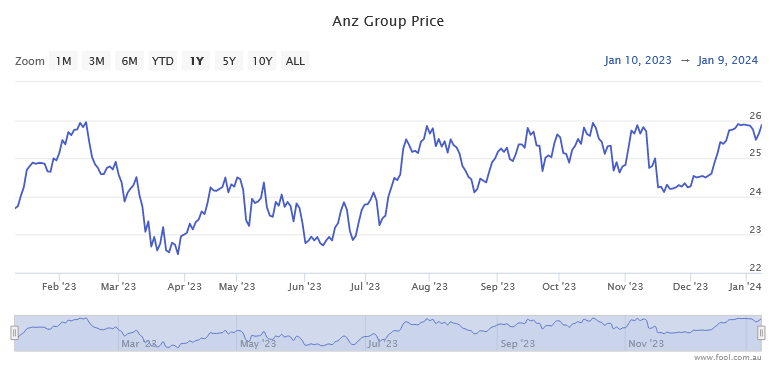

The ANZ Group Holdings Ltd (ASX: ANZ) shares have had a bit of a wild year over the past 12 months.

Sure, this ASX 200 bank stock is, on paper, up a healthy 7.58% since January 2023. However, it's been a bit of a rollercoaster ride along the way, with ANZ shares fluctuating between $22.39 and $26.08 a share (that's a difference worth 16.5%).

Check it out for yourself below:

But I think that ANZ shares are primed for a great year in 2024. Why? Well, for one simple reason: the dividend yield will be too good to turn down.

Why ANZ's dividends could give shares a boost

As an ASX bank share, ANZ is a popular choice for income investors. It's not hard to see why. Right now, ANZ is trading with a trailing dividend yield of 6.78% (as of yesterday's close).

This derives from the bank's last two dividend payments. The first was the July interim dividend of 81 cents per share. The second, the December final dividend of 94 cents per share.

Those were both healthy increases over their 2022 counterparts of 72 cents and 74 cents per share, respectively. Saying that, ANZ's most recent dividend only came partially franked at 54%, which was a bit of a departure from the bank's norms.

A 6.78% dividend yield is a fairly compelling reason to buy a company's shares right off the bat. But here's why I think ANZ could get a share price boost in 2024.

Last week, my Fool colleague James covered the views of ASX broker Goldman Sachs on ANZ. Goldman reiterated its buy rating on the bank, which is a positive in itself. But the broker also forecasted that ANZ would be able to fund fully-franked dividends worth $1.62 per share over both FY2024 and FY2025.

If accurate, this would mean investors are set to enjoy a yield of 6.3% (or 8.98% grossed-up with that full franking) over at least the coming 18 months or so. That's based on yesterday's closing share price.

If interest rates begin to fall in 2024, a yield of 6.3% (or nearly 9% grossed-up) might begin to be difficult to ignore for many income investors. Plus, the ANZ share price is relatively cheap on a price-to-earnings (P/E) basis compared to the other big ASX banks today.

Foolish takeaway

So all in all, I think this bank's ability to fund fat and fully-franked dividends over the foreseeable future will mean its share price gets a rush of fresh interest this year. I (or Goldman Sachs) could easily be wrong here.

But I wouldn't be surprised if ANZ shares end 2024 at a higher price than what we are seeing today.