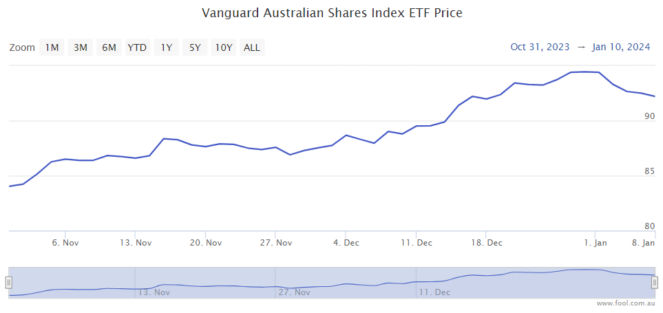

The Vanguard Australian Shares Index ETF (ASX: VAS) is on a strong run for shareholders. It has risen by more than 10% since 31 October 2023 after a rally for ASX shares, and it's close to its 52-week high.

The VAS ETF tracks the S&P/ASX 300 Index (ASX: XKO), which is a group of 300 of the biggest companies on the ASX. The bigger the company's market capitalisation, the more money that's allocated to it in the exchange-traded fund's (ETF) portfolio.

For example, at the end of November 2023, 10.8% of the VAS ETF portfolio comprised of BHP Group Ltd (ASX: BHP) and 8.1% of Commonwealth Bank of Australia (ASX: CBA).

The share prices of that collective group of ASX 300 shares have lifted in the last few months. Is it too late to invest in the ETF?

Improving picture for ASX shares

The ASX 300 is getting a boost from the strong iron ore price, which is supercharging the profitability potential of names like BHP, Fortescue Ltd (ASX: FMG) and Rio Tinto Ltd (ASX: RIO).

The iron ore price has reached US$140 per tonne, up from less than US$120 per tonne a few months ago. That's why there has been a rally of those ASX iron ore shares over the last few months.

ASX bank shares have also climbed recently, with CBA shares up 17% since 31 October 2023, Westpac Banking Corp (ASX: WBC) shares have risen 12.1%, the ANZ Group Holdings Ltd (ASX: ANZ) share price has gone up 4.8%, and the National Australia Bank Ltd (ASX: NAB) share price has gone up 10.1%.

With the rise in interest rates possibly over, this could mean the economic picture for borrowers is better than it could have become, which may mean lower arrears and bad debts for banks than some investors were worrying about.

That's also potentially good news for ASX retail shares because it means more money left in the hands of householders, which they can spend. Wesfarmers Ltd (ASX: WES) – the owner of Bunnings and Kmart – has seen its share price rise 12.5% since 31 October 2023.

Is it too late to invest in the VAS ETF?

The VAS ETF unit price is higher now than it was a couple of months ago. So, it may be too late to catch that lower price.

But, it could be a mistake to think that the VAS ETF won't increase any more from here.

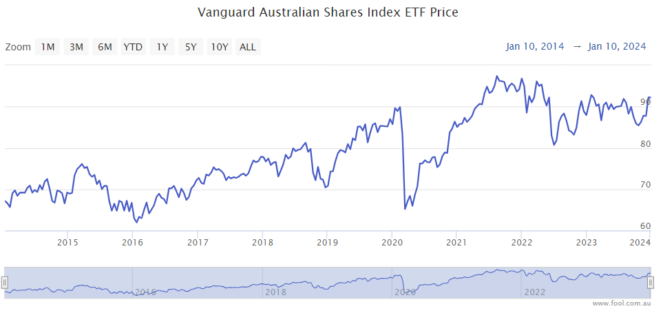

Just look at the Vanguard Australian Shares Index ETF unit price over the past decade – there have been some bumps, but it has slowly risen over time. Plus, investors have received a lot of dividend income over that time.

Companies are always thinking of ways about how to make more money next year, and in the future. ASX shares are putting money towards growth – marketing, new technology, new locations/services and so on.

I'd be very surprised if the VAS ETF rises another 10% over the next six months, but over the long term, I think there's a good chance it will go higher. Investors can always buy VAS ETF units when the market is open if desired.

I'd also point out there are always opportunities with individual ASX shares, which is where I tend to invest.