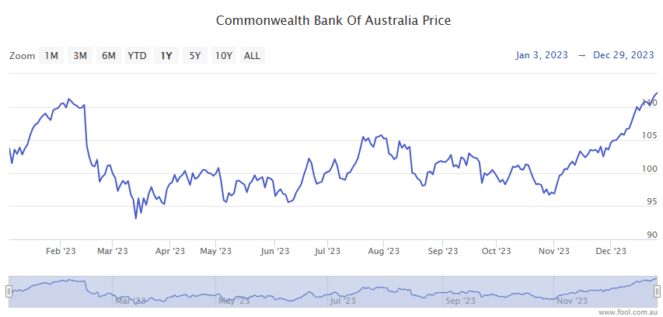

Commonwealth Bank of Australia (ASX: CBA) shares delivered some inflation-busting returns in 2023.

On 30 December 2022, shares in the S&P/ASX 200 Index (ASX: XJO) bank stock closed trading for $102.60. By the time the closing bell sounded the end of the 2023 trading year on 29 December shares were swapping hands for $111.80 apiece.

That sees CBA shares up a healthy 9% for the calendar year.

But let's not forget the big bank's fully franked dividends.

In 2023, CBA paid out an interim dividend of $2.10 a share on 30 March and a final dividend of $2.40 on 28 September.

That equates to a 2023 payout of $4.50 a share, with potential tax benefits.

If we add those dividends back in, the accumulated value of CBA shares gained 13.4% over the year just past.

Here's what drew ASX 200 investor interest.

What sent CBA shares higher in 2023?

Despite ongoing stiff competition in Australia's lucrative mortgage market pressuring net interest margins, CBA shares booked some eye-popping profits in 2023.

At the bank's 2023 financial year results (which includes the latter half of the 2022 calendar year), CommBank reported a 13% year on year increase in its operating income to $27.24 billion. And the bank's cash net profit after tax leapt 6% from FY 2022 to $10.16 billion.

Following on those results, CBA's CEO Matt Comyn noted the bank's "portfolio quality has remained sound with arrears and impairments below long-term averages, supported by a strong labour market as well as savings and repayment buffers".

CBA shares gained 2.6% on the day.

ASX 200 investors also appeared pleased by CommBank's solid first quarter update, released on 14 November.

Operating income for the three months was in line with the prior corresponding quarter, at $6.82 billion.

And the bank's cash net profit after tax increased by 1% to $2.5 billion.

CBA also ended the year in a strong position in case of any unexpected financial shocks.

The bank reported a 0.46% increase in its common equity tier 1 (CET1) ratio to 11.8%. The CET1 ratio, if you're not familiar, measures the core equity capital of a bank compared to its risk-weighted assets.

CBA shares gained 1% on the day the bank reported its quarterly results.

What's happening in 2024?

With less than two hours to go on this first trading day of 2024, it's looking like another strong session for CBA shares.

The ASX 200 bank stock is up 1.3% in afternoon trade on Tuesday. Shares are swapping hands for $113.22 apiece, marking a new 52-week high.