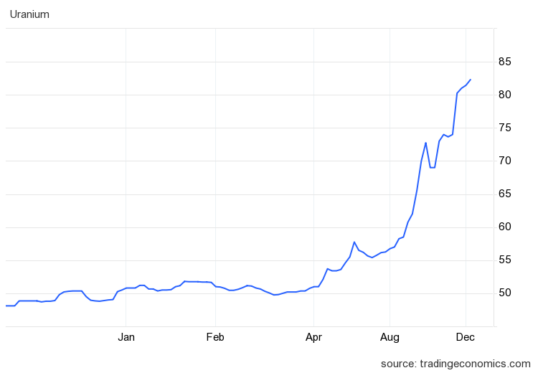

Uranium has been on absolute fire in 2023.

Last year's invasion of Ukraine struck energy anxiety into much of the developed world and, along with the need to lower carbon emissions, the situation forced many countries to seek alternatives.

Nuclear power, capable of producing huge amounts of electricity while producing low emissions, has come back into vogue more than a decade after the Fukushima disaster in Japan.

Late this year, conflict broke out in the Middle East, which triggered even more fear about energy security.

The United Nations' COP28 climate change conference this month also emphasised the critical role nuclear power has to meet global energy demand in the coming decades.

That's why uranium, as one of the main fuels for nuclear power, has seen its price skyrocket this year.

The global price started 2023 at just under US$50 per pound. It is now hovering more than 60% higher.

"Uranium prices in the US surged past US$82 per pound for the first time since January 2008, soaring past pre-Fukushima disaster levels as high demand was met with increasing supply risks," stated TradingEconomics.

So after this spectacular rise, what will happen to uranium and uranium shares in 2024?

Renewable projects cancelled

Fairmont Equities managing director Michael Gable noted that many wind and solar power generation projects have been "cancelled or delayed" in 2023.

"When money and energy were cheap, there was progress being made, but the numbers just don't stack up anymore with higher interest rates and commodity costs," Gable said on the Fairmont blog.

"This is why governments are [turning] to nuclear power to fill in the gap."

He explained how after the Cold War ended in the 1990s, Russia and the USA dismantled many nuclear warheads and put the remaining uranium on the market, forcing prices down.

After supply dwindled, the uranium price rocketed in the mid-2000s. The Fukushima disaster then came along in 2011 to once again collapse the price.

With many countries closing their nuclear plants permanently after that, many uranium mines were deactivated.

But now, with the world turning back to nuclear, Gable says uranium is, for the first time, in a "structural deficit" that could "take years to correct".

"The Sprott Physical Uranium Trust, which buys and sells physical uranium, has been only able to source small amounts in recent months, leaving it with about $60 million of cash on its balance sheet.

"That is, a physical-backed trust just can't find enough physical to buy."

Uranium shares to make hay while the sun shines

This is why Gable is bullish for uranium to zoom ahead further in 2024.

"With almost no uranium around, we could see quite a move in uranium prices for years before supply finally catches up."

The supply side is suffering from setbacks around the world, according to TradingEconomics.

"The US lower house passed a bill to ban the import of nuclear fuel from Russia, the world's top producer of enriched uranium and the biggest US supplier, magnifying supply risks following European utility's partial shunning of Russian nuclear fuel.

"The developments added to supply risks from elsewhere, including uncertainty from Niger's military coup and lower output from Canada."