More than one analyst this year has been telling anyone who would listen that copper is just as important as lithium for a world transitioning to lower carbon emissions.

That's because the metal is a critical ingredient for electronics, electric motors and electrical wiring.

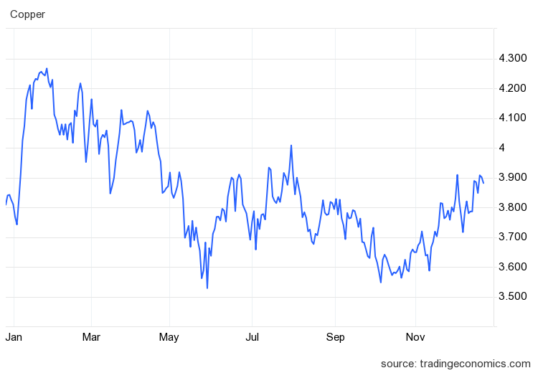

However, as western economies grappled with high inflation and China struggled with deflation, the price for copper never really took off as some forecast.

In fact, after dipping into the second half of this year, it has only just recovered to be roughly where it started 2023.

For those considering adding ASX copper shares to their portfolios while they're cheap, Fairmont Equities managing director Michael Gable had some thoughts about what the commodity might do in 2024.

'A bellwether for economic growth'

Gable observed how copper demand is indicating that the worst of China's economic woes could now be behind it.

"Copper is known to be a bellwether for economic growth," Gable said on the Fairmont blog.

"For the first 8 months or 2023, year on year copper demand is up 11% and most of that is coming from China. Chinese demand is up 12% year on year for the first 9 months of this year."

Another high-growth economy, India, is also thirsty for copper.

"Indian demand is now up 36%.

"On a days-of-cover basis, inventories are now at 3 days — a level which historically leads to near-term price spikes."

Experts (again) predicting a rally for copper shares

Gable is far from the only expert still bullish on copper shares.

Last month Bell Direct market analyst Grady Wulff said the experts she's spoken to are again predicting a rally for copper in 2024.

"There's no denying it had a false start, but the outlook from analysts, fund managers and those at the helm of resources companies is [that] copper is a hot commodity and key element in the energy transition," she said.

"[This is] not just from an EV front, but for transmission efficiency, reducing emissions and its role in energy storage systems."

The most prominent copper shares on the ASX include Sandfire Resources Ltd (ASX: SFR), BHP Group Ltd (ASX: BHP) and Aeris Resources Ltd (ASX: AIS).

Sandfire is by far the largest standalone copper producer, while BHP is a huge player that also has interests in other minerals. Aeris is the second most productive copper-only miner.