The Commonwealth Bank of Australia (ASX: CBA) share price is inching closer to a new record high on Wednesday.

Australian shares are in fine form today, as all ASX sectors manage to dodge any sign of selling pressure. Amid the positivity, several blue-chip companies are reaching fresh 52-week highs, and CBA shares are not too far behind.

At the time of writing, CBA shares are attracting a sticker price of $110.91 apiece, rising 0.3% from their previous close. For context, the S&P/ASX 200 Index (ASX: XJO) is a smidgen better off, gaining 0.5% as we head into the afternoon.

Is the CBA share price set for a record?

The past seven weeks have given rise to an incredible 15% rally in CBA shares. In less than two months, Australia's biggest bank has seen its share price recover from near 52-week lows ($96.22) to near all-time highs.

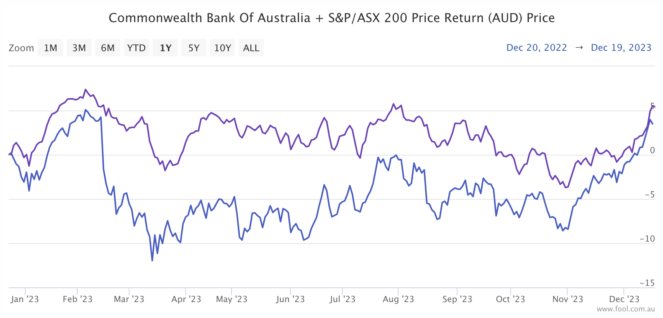

Before getting too excited, we should get some context. Optimism was shared across the Aussie benchmark index during this time, giving the ASX 200 an 11% bounce over the same period, as shown below.

Before 30 October 2023, CBA shares were staring down the barrel of an 8% fall for the year. However, both the bank and the benchmark experienced a shift in momentum in November as the 4.35% interest rate began looking more likely to be the current cycle's peak.

Suddenly, the chances of a 'soft landing' for Australia's economy seemed more probable. That means emerging from the inflation-crunching period without suffering a recession and the damage to household wealth that can come along with it.

This is perceivably good news for CBA and its share price. After all, it — as with all banks — is exposed to the financial hardship of its customers to varying degrees. A hard landing could have major ramifications if credit quality were tested under severe conditions.

Instead, market pundits are now pencilling the first interest rate cut as early as mid-next year.

Given the CBA share price is less than 1% away from its all-time high of $111.43, a new record price in 2023 is feasible. In financial market terms, a move of this size is a figurative sneeze away.

Any additional positive sentiment around Australia's economy or improved lending could be enough to take CBA shares over the line.

However, the same can be said in the opposite direction. The CBA share price could retreat again if the rosy outlook begins to wane.