After a choppy year, the S&P/ASX 200 Index (ASX: XJO) currently has some bargains begging to be picked up before a boom 2024.

Baker Young managed portfolio analyst Toby Grimm named two such ideas this week:

'Shares are attractive at recent levels'

For some reason Treasury Wine Estates Ltd (ASX: TWE) has failed to impress the market in 2023, despite best efforts.

The stock price is now down more than 22% over the past year.

"The premium wine maker has been sold off after announcing a US$900 million acquisition of Daou Vineyards and subsequent equity raising on October 31. Daou is a luxury wine brand based in California," Young told The Bull.

For the last 18 months, investors have been anticipating a massive catalyst for Treasury Estates.

Back in 2020, the company lost a huge export market when China imposed tariffs on Australian wine as retaliation for calls for an enquiry into the origin of COVID-19.

After a change of government in Canberra, there was hope that diplomatic relations between Australia and its largest trading partner might warm.

Young feels like picking up Treasury Wine shares right now could be wise with that punitive measure still in place.

"We believe the shares are attractive at recent levels, particularly if China reduces tariffs on imported Australian wine."

The ASX 200 stock ready to soar to 'intrinsic valuation'

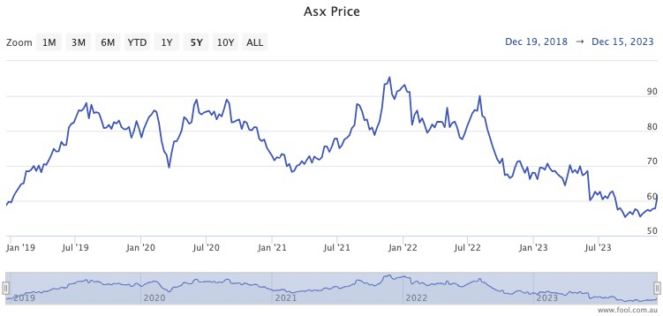

The ASX Ltd (ASX: ASX) itself is an ASX 200 stock, but it hasn't been talked about much among investors due to its troubles upgrading technology.

Young reckons some recent decisiveness could provide a boost to the share price, which has tumbled more than 12.5% since April.

"Following several years and an investment of hundreds of millions of dollars in unsuccessful blockchain settlement technology, the ASX has finally abandoned the costly strategy in favour of a revamped CHESS system.

"This decision, while still requiring increased capital expenditure, reduces near-term uncertainty."

The ASX Ltd share price is hovering in the low $60s at the moment, but Young's team thinks it can move up to its "intrinsic valuation" of $72.50.

Young's peers aren't quite as convinced, with only three out of 10 analysts currently surveyed on CMC Invest rating ASX Ltd shares as a buy.