How good would it be to earn enough passive income to be able to walk away from your day job tomorrow?

Imagine going up to the boss then telling her or him you're out of there and never coming back.

With many Australian households struggling under the strain of 13 interest rate rises this Christmas, I'm sure that sounds like a pretty sweet dream.

But using the power of compounding and ASX shares, chucking in the day job is not as unrealistic as what you might think.

Let me take you through some hypotheticals.

The ASX is full of growth opportunities

Research from comparison site Finder earlier this year found the average Australian has $40,000 saved up.

If you're in a domestic relationship, you might even jointly have $80,000 available to invest.

There are many ways to grow this pot, but I personally favour ASX growth shares in the long run.

Compared to dividend shares, they obviously have more capital growth potential and a bit less maintenance in not having to worry about reinvesting income.

There are some terrific opportunities on the ASX.

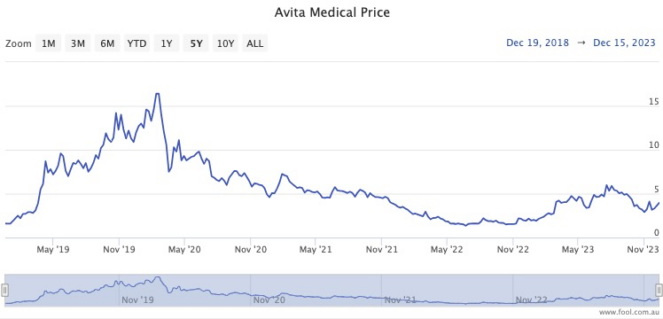

For example, burns treatment maker Avita Medical Inc (ASX: AVH) has rocketed 144% over the past five years.

That's despite massive dips during the COVID-19 pandemic and a 53% sell-off this year.

It shows the power of holding onto quality businesses through thick and thin.

Past performance is never an indicator of the future, but let's calculate the compound annual growth rate (CAGR) just to demonstrate how well growth stocks can fatten up your portfolio.

Avita Medical, per year, has returned 19.5% over those five years.

Diversify diversify diversify

So let's create a portfolio of excellent growth stocks with your initial $80,000.

Of course, not every stock you pick will perform as well as Avita Medical has the past few years.

But with proper diversification, perhaps you put together a mixture of Avitas, some stocks that have lost money, and some in between.

If you can manage an overall CAGR of 12%, your investment is well on your way for you to quit.

That $80,000, growing at 12% each year, and with you and your partner chipping in $800 each month, will turn into these amounts depending on how patient you can be:

| Years | Portfolio value (rounded down) |

| 10 | $416,935 |

| 13 | $618,158 |

| 15 | $795,770 |

| 17 | $1,018,566 |

How long you let it brew really depends on the level of passive income you desire.

For ease of calculations, let's say you can squeeze 10% income out of the eventual amount as your growth companies mature.

After 10 years, you could then receive about $41,700 of passive income each year. If you can hold on until year 15, almost $80,000 in cash could then land in your bank account annually.

Supreme patience to wait until the end of 17 years could see you and your partner receive six-figures each year without lifting a finger. For the rest of your lives.

Tell your boss to put that in his pipe and smoke it.