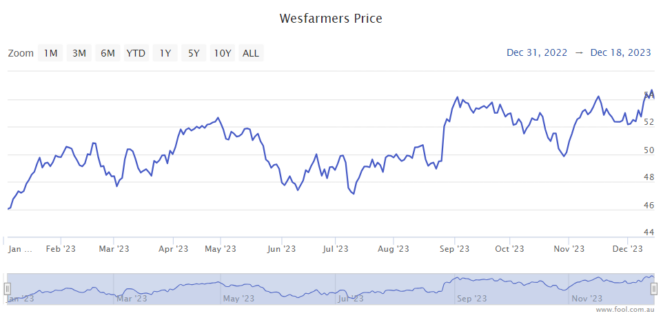

The Wesfarmers Ltd (ASX: WES) share price reached a 52-week high today, rising up to $55.48 before falling into the red in late afternoon trading.

While there has been plenty of volatility over the year, the company looks set to end 2023 on a high. In the year to date, it has risen around 20%. Wesfarmers has done much better than the S&P/ASX 200 Index (ASX: XJO) which has only risen by around 7%.

The company has not announced any market-sensitive news for a while. But, the latest two announcements relating to business progress have been promising.

Completion of Silk acquisition

At the end of November, Wesfarmers announced it had completed the acquisition of Silk Laser Australia.

This business will become part of the Wesfarmers Health division, which will complement the Clear Skincare business by providing "additional scale and efficiency benefits in the attractive and growing market for medical aesthetics products and services."

The Wesfarmers Health managing director Emily Amos said:

Through this acquisition, we are looking to build a leading medical aesthetics operator in Australia and New Zealand.

We see strong operational and cultural alignment between our businesses and look forward to working with the SILK team and SILK's joint venture and franchisee partners to support their customers and deliver continued growth.

Solid performance in a weakening retail environment

The Wesfarmers share price is supported by the key businesses of Bunnings and Kmart – they generate the most earnings for Wesfarmers.

At the AGM a couple of months ago, management said the strong value credentials and core everyday offer of its retail businesses position the business "well to meet changing customer demand, acquire new customers and profitably grow market share."

The costs of doing business remain "elevated", caused by things like inflation, labour market constraints and wage costs, higher energy prices and a lower Australian dollar. Wesfarmers' larger businesses are leveraging their scale and sourcing capabilities, and all businesses are maintaining a "focus on proactive investments in productivity and efficiency measures."

While Bunnings' sales growth hadn't been strong, it remained "in line with the second half of the 2023 financial year, with growth in both consumer and commercial segments." Demand for products that support necessary repair and maintenance and smaller scale projects remains robust, and Bunnings has seen increased foot traffic to stores.

Kmart has continued to deliver strong financial results thanks to its "market-leading value credentials", which are "resonating with an increasingly wide cross-section of households."

While other divisions aren't performing as well, they are doing well operationally.

Expectations of continued good performance may be helping the Wesfarmers share price.

Wesfarmers share price snapshot

Over the past five years, Wesfarmers has climbed by more than 70%.