The Lendlease Group (ASX: LLC) share price is in the green today.

Shares in the S&P/ASX 200 Index (ASX: XJO) property and infrastructure group closed on Friday trading for $7.51. In morning trade on Monday, shares are swapping hands for $7.69 apiece, up 2.4%.

For some context, the ASX 200 is down 0.4% at this same time.

This comes after the company announced a major asset sale to Stockland Corp Ltd (ASX: SGP).

The Stockland share price is down 3.6% on the news.

Here's what's happening.

What asset sale was announced?

The Lendlease share price is outpacing the ASX 200 after the company reported it has entered into an agreement to sell 12 Australian master-planned communities projects to Stockland and its capital partner, Supalai Australia Holdings, for $1.3 billion.

Stockland will hold a 50.1% interest, with Supalai holding a 49.9% interest in the projects, which total around 27,600 lots.

Lendlease said the sale will enable it to reweight capital to investments, reduce its gearing and realise the value it created in these projects.

The company expects the transaction to realise a roughly 20% premium to book value (pre-tax) and contribute $130 million to $160 million to its FY 2024 core operating profit after tax.

Management expects to see the cash proceeds paid equally across FY 2024 and FY 2025, with the final instalment due in early Q3 FY 2025.

Four projects with an FY 2023 book value of $200 million will remain with Lendlease amid expectations they could achieve greater future value through additional development.

Commenting on the sale that's boosting the Lendlease share price today, CEO Tony Lombardo said:

The $1.3 billion sale of 12 master-planned communities provides Lendlease an opportunity to crystalise the value we have created in these projects. We remain focused on recycling capital to accelerate our investments-led strategy and to maintain balance sheet flexibility to pursue future opportunities.

Stockland CEO Tarun Gupta added:

The acquisition represents a step change in the reshaping of our portfolio and accelerates the execution of our strategy by increasing our capital allocation towards residential sectors while scaling our capital partnership platform and generating new sources of recurring income.

Lendlease expects to receive initial approvals and first financial settlement in Q3 FY 2024.

The transaction remains subject to the standard conditions, including Foreign Investment Review Board approval.

Lendlease share price snapshot

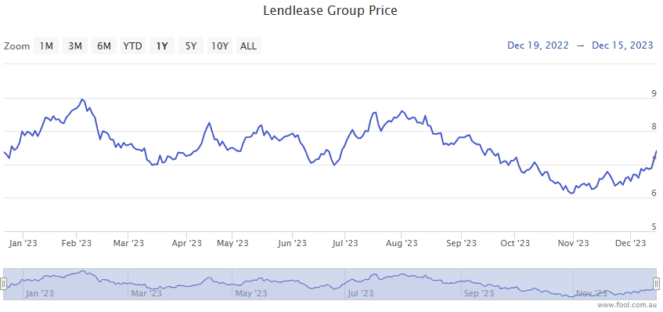

The Lendlease share price is up 5% over the past full year.

The Stockland share price has gained 13% over that same time.