Has a bull market started already? The S&P/ASX 200 Index (ASX: XJO) is now up 4.8% this month.

Regardless of whether it's already commenced or it's a false dawn, there are some quality shares you will want to have in your portfolio before everyone else piles back into the market.

The healthcare sector, especially, hasn't had the best time over the past couple of years as interest rates rapidly rose 13 times.

So here are three ASX healthcare stocks that you could buy now to bring a smile to your face in 12 months' time:

Not too late for those who want this action

Resmed CDI (ASX: RMD) shares fell off a cliff in August as panic spread about the adverse impact of new GLP-1 weight loss drugs on the sleep apnoea device maker.

Many experts back then insisted that the fear was unjustified. And the last few weeks may be showing that they were right.

Since 27 October, the ResMed share price has roared back almost 20% as investors realise the long-term global addressable market for sleep apnoea therapy is still massive.

Many shrewd investors, both professional and amateur, picked up ResMed shares during that dip.

But it's not too late for those wanting a piece of the action, with the stock still trading at a 23.9% discount compared to early August.

An assuring 18 out of 24 analysts currently believe ResMed shares are a buy, according to CMC Invest.

Unanimous buy for this healthcare stock

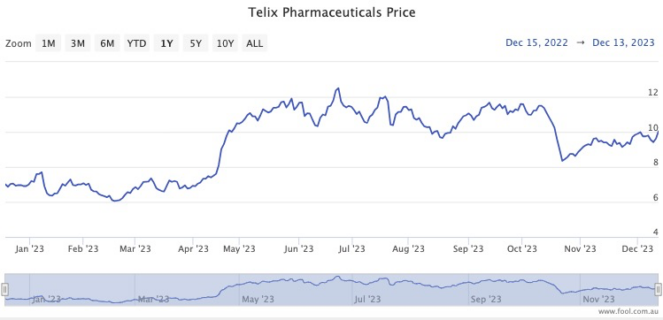

Telix Pharmaceuticals Ltd (ASX: TLX) is recovering from a dip of its own, so is in a great spot to be picked up for a bull market.

It's 17.6% up since 20 October after a painful 26.8% fall that month.

Nevertheless, it is still trading more than 40% higher than where it started in 2023 to show an upward trend for the emerging cancer treatments business.

Telix put out its first commercial product last year and is raking in revenue from that while progressing other products through research, testing and approvals.

Those in the know are pretty confident its pipeline will produce more commercially viable cancer solutions, as all seven professional investors surveyed on CMC Invest rate the stock as a buy.

Doubled share price in 2023, double or nothing in 2024?

Perhaps the riskiest out of the three healthcare stocks — but potentially with the highest reward — is Neuren Pharmaceuticals Ltd (ASX: NEU).

It has been absolutely on fire this year, doubling since January 1.

Just over the past seven weeks the share price has rocketed 68.4%.

The company develops therapies for rare brain-related conditions.

As it exits the pre-revenue stage of its lifecycle, does Neuren have the legs to climb further?

Three of four experts surveyed on CMC Invest rate Neuren Pharmaceuticals shares as a buy, so apparently it has a fighting chance.