Despite all the data, computer screens and spreadsheets, the stock market can get pretty emotional.

That is, it could sell off ASX shares excessively out of fear rather than based on the long-term trajectory of the underlying business.

I feel like that is the case with Avita Medical Inc (ASX: AVH) at the moment, presenting opportunistic investors with a window to buy some cheap ASX shares.

Let's break it down:

Revenue forecast downgraded

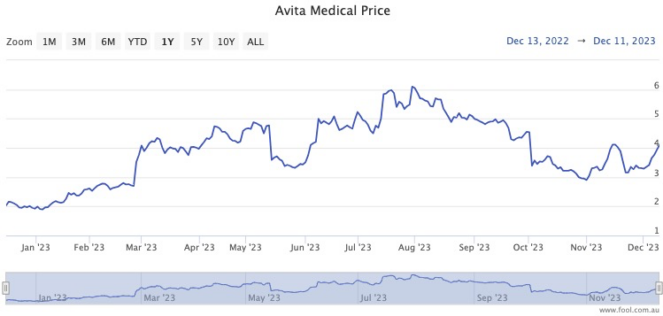

The Avita share price has dipped close to 40% since the start of August.

The latest sell-off, back in mid-November, was triggered by a revision to its revenue guidance.

"The company is downgrading its full-year 2023 commercial revenue guidance from the previously disclosed range of US$51 million to US$53 million to a new range of approximately US$49.5 million to US$50.5 million," reported The Motley Fool's James Mickleboro.

Although investors would have been disappointed with the downgrade, Mickleboro pointed out the burns treatment provider's sales are still expanding strongly.

"It is worth highlighting that this still reflects growth rates of approximately 45% and 48%, respectively, over the same period in 2022."

Avita chief executive Jim Corbett explained how a slower-than-anticipated progress through the Value Analysis Committee (VAC) processes is a short-term hiccup, rather than a chronic issue.

"Although the VAC processes are taking longer than anticipated, we expect that once completed, the process will yield positive approvals and an expanded market opportunity," he said.

"The broader clinical involvement validates the substantial market opportunity this expanded label represents, which is greater than 10 times the size of the burn market."

But that's what makes these ASX shares cheap

This is why I would be tempted to add to my Avita Medical holding during this price dip.

I'm not alone in this bullishness.

According to CMC Invest, all 10 analysts who currently cover this medical stock reckon it's a buy. Eight of those think it's a strong buy.

Despite the recent sell-off the stock price is still 92% up year to date. Over the past five years, the Avita share price has soared more than 131%.