The Coles Group Ltd (ASX: COL) share price will be under pressure on Friday after the supermarket was forced to apologise for acts that a consumer group labelled "shonky".

Consumer advocacy organisation Choice revealed that Coles was "caught red-handed" raising prices of items that were advertised as "locked" for a certain period.

The group passed on the findings to the Australian Competition and Consumer Commission back in October, and this triggered an apology and mass refunds from the supermarket this week.

Coles shares were down 0.51% in early trade on Friday morning.

Choice deputy director of campaigns Andrew Kelly said his team was "pleased to see the ACCC has followed up on our complaint" and the subsequent apology.

"This kind of behaviour from Coles is exactly why we gave them a Shonky Award earlier this year," he said.

"Coles has been touting how they're supposedly helping with the cost of living crisis, all while banking huge profits and not following through on pricing promises made to their customers."

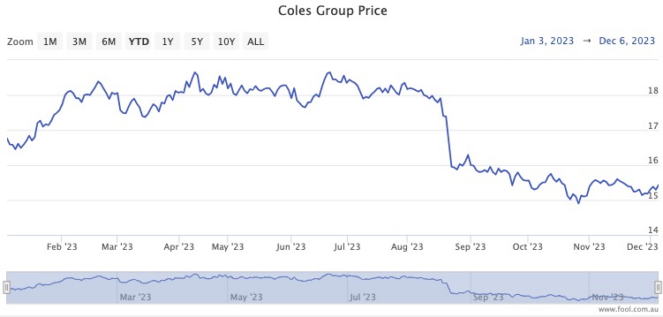

Coles shares under pressure this year

A Coles spokesperson acknowledged that 20 products had their prices raised before the end of the advertised promotional period.

"We sincerely apologise to our customers for this mistake and we are working quickly to make it right.

"As a result of this error, we are refunding the full cost of the items to customers."

According to Kelly, a dominant supermarket like Coles not meeting its price promises is "simply unacceptable".

"If Choice hadn't picked up on this significant error, it's possible thousands of people would still be out of pocket without even realising.

"Choice will continue to call out retailers who do the wrong thing by consumers, and other supermarkets should be on notice that they will not get away with any kind of bad behaviour."

Coles shares are currently rated as a buy by just four out of 15 analysts surveyed on CMC Invest.

The stock price has tumbled almost 15% since the start of the August reporting season.

The supermarket giant pays out a fully franked dividend yield of 3.9%.