Australia collectively breathed a sigh of relief this week as the Reserve Bank of Australia decided to leave interest rates as is.

Maybe that's it for hikes, maybe there's one more rate rise left. Either way, it's now close enough to the peak.

That means that some stocks can look forward to boom conditions in 2024.

Some ASX shares in the healthcare sector that are in the developmental or early commercial stages of their products could benefit from this friendlier environment.

Let's take a look at two such companies:

Maybe a buying window for these healthcare shares

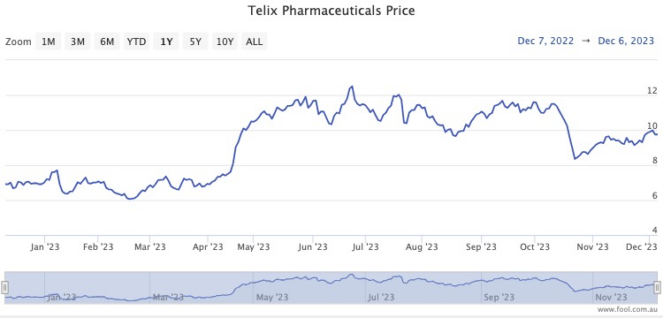

Cancer diagnostics and therapy maker Telix Pharmaceuticals Ltd (ASX: TLX) has seen its shares go on a wild roller coaster ride in 2023, typical of early stage biopharmaceutical businesses.

From the start of the year to mid-June, the share prices rocketed almost 80%. Then an October cliff saw it slide 34% downwards, with a recent recovery leaving it up 39.4% year to date.

With the share price still more than 21% off that June peak, I feel like there is excellent potential next year for capital growth.

The company put out its first commercial product Illucix last year in the US, which has pushed the business out of the pre-revenue phase. Sales have been strong, and the diagnostic tool will enter the Australian market soon.

In the future pipeline, Telix has several diagnostic and therapeutic products for different types of cancers currently in testing or awaiting regulatory approval.

Needless to say, each one of those is a stock price catalyst.

The professional community loves Telix, with all seven analysts surveyed on CMC Invest currently rating it as a buy.

Can this stock follow a sensational 2023 with a similar effort in 2024?

Similarly, the Neuren Pharmaceuticals Ltd (ASX: NEU) share price has been topsy-turvy this year.

It was only mid-March when the stock had already risen more than 50% for the year. Then an almost 30% decline from July to October delivered a reality check for investors.

But since 26 October, investors have been going mad for Neuren again, shooting up an incredible 54%.

That leaves the Neuren Pharmaceuticals share price soaring more than 80% year to date, and up an amazing 113% over the past 12 months.

So how could it rise again next year?

Check out this analysis from the team at the Elvest Fund.

"The company is currently conducting phase 2 trials of its second drug candidate, NNZ-2591, for a range of disorders," read its memo to clients this week.

"Phase 2 top-line results are due in December 2023 for the first of these, Phelan McDermid syndrome (PMS)."

Neuren Pharmaceuticals is in an enviable position because it already rakes in revenue from licensing its Daybue product to US giant Acadia Pharmaceuticals Inc (NASDAQ: ACAD).

This is why, notwithstanding the steep rise in the share price, all five analysts surveyed on CMC Invest reckon Neuren is still a buy.