ASX shares and investors will be watching keenly on Tuesday afternoon for a catalyst that could rock the market.

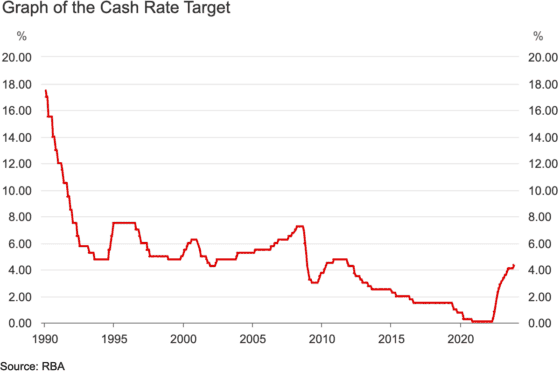

At 2:30pm, the Reserve Bank of Australia board will be handing down its last scheduled cash rate decision for the year.

Fortunately for stocks, mortgage holders and business owners, the majority of experts are tipping interest rates to remain as is.

With Australia's inflation still hovering a bit higher than the US, a hold will come as a relief and could push ASX shares higher with confidence.

Most experts agree interest rates will be frozen for Christmas

According to a survey of economists conducted by comparison site Finder, 82% of the boffins reckon interest rates will be kept on hold on Tuesday.

The monthly inflation figures last week came in lower than expected, which could guide the Reserve Bank decision, according to CreditorWatch chief economist Anneke Thompson.

"This monthly CPI release, combined with weak consumer spending and rising numbers of unemployed people, means the RBA will almost certainly hold the cash rate steady at the December meeting," she said this week.

"This is good news for retailers and summer holiday makers, though consumers are likely to be wary of the fact that interest rates are likely to stay high until at least Q3 2024."

UNSW associate professor Evgenia Dechter agreed interest rates would be kept on ice with inflation slowing.

"Other domestic and global indicators also project a slowdown in the Australian economy," she said.

"However, immigration inflow remains high, creating an upward pressure on prices in the short run."

A separate Finder study found 37% of homeowners are now struggling to make their mortgage repayments.

But fierce disagreement on whether rates have peaked

The experts, however, are divided as to whether this is now the end of rate rises.

While 54% reckon the RBA cash rate has peaked at 4.35%, the other 46% think there is another hike coming.

Pathfinder Consulting managing director Peter Boehm pointed out food and energy costs are still heading up.

"If inflation ticks up, you should expect a rate rise in Feb 2024."

According to Bendigo Bank head of economic research David Robertson, relief could still be more than a year away.

"Next year the risk remains for one more increase as quarterly CPI data is released- most likely in May. Rate cuts are expected in 2025."