December is here but there is no holiday for ASX shares.

Just take a look at this huge week coming up, as summarised by eToro market analyst Josh Gilbert:

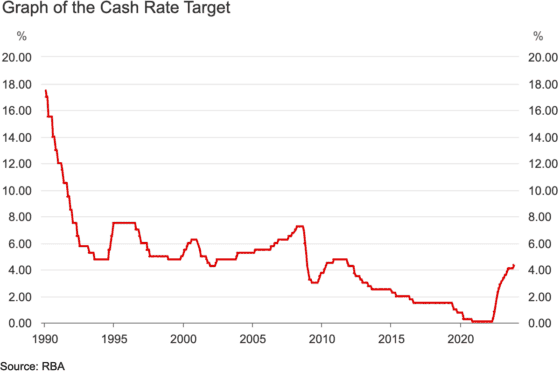

1. Reserve Bank of Australia rate decision

A no-brainer for the biggest event of the week, Gilbert wonders if the Reserve Bank of Australia will play the Christmas Grinch with an interest rate hike on Tuesday afternoon.

"Right now, the likelihood of that is fairly low – but the governor [Michele Bullock] has maintained a hawkish tone in recent weeks," he said.

"Specifically, Bullock has spoken about homegrown inflation being more persistent than expected, which will certainly keep markets on edge heading into Tuesday's decision."

Both financial markets and economists are forecasting a hold this time, but Gilbert reminded the reprieve could be short-lived.

"[A hold] doesn't mean there isn't the potential for another hike early next year if key data points don't move in the right direction.

"We're unlikely to see any lighter tone from the RBA, and Michele Bullocks' hawkish rhetoric may be front and centre once again."

2. Australia gross domestic product

The headline number that indicates the nation's economic health comes out on Wednesday.

September's 0.4% GDP growth was a relief, according to Gilbert, after the June quarter produced "the weakest result since the COVID-19 Delta lockdown contraction in September 2021".

"There are some potential impacts to consider ahead of Wednesday's reading," he said.

"Retail sales have slowed following a relatively quiet October and a seemingly underwhelming Black Friday period, with plenty of households keeping the purse straps tight as supermarket prices continue to climb."

Again economists are expecting 0.4%, which Gilbert reckons could be on the money.

3. China inflation

While Western countries wrestle with high inflation, Australia's largest trading partner has been fighting deflation all year.

"Last month, China fell into deflation for the second time in 2023 as consumers continue to hold back their spending due to a deepening property crisis in the region," said Gilbert.

"The region's bad news continues to stack, with weaker-than-expected manufacturing data being handed down last week."

However, Gilbert reminds investors that in the past, China has been more than willing to inject stimulus to rejuvenate a lagging economy.

"Recent stimulus measures for the property sector are good news on inflation, given that they should help to reduce the impact on household pressures such as wages and employment and therefore improve consumption."

But for now, the forecast is that China will remain in deflation.

"The consensus this week is for CPI to come in at -0.2%, reflecting the ongoing struggles and solidifying China as the market disappointment of 2023."