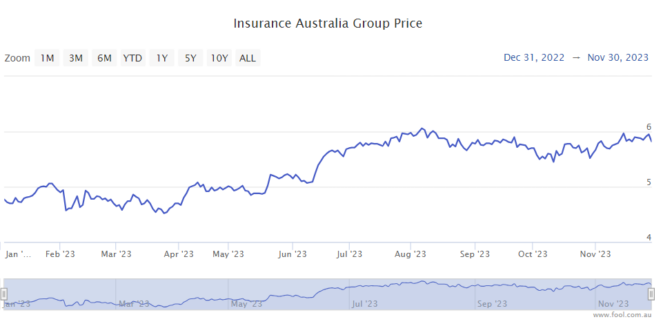

Insurance Australia Group Ltd (ASX: IAG) shares have done very well – in 2023 they have gone up 27% to date, as we can see on the chart below. With positivity building, what is the outlook for IAG shares in 2024?

As a reminder, the company operates a number of brands including NRMA Insurance, CGU, SGIO, SGIC, Swann Insurance, WFI and Lumley Insurance.

Helpful factors

The business is seeing inflation of premium prices, which is a tailwind for gross written premiums (GWP), revenue and potentially insurance profit if margins stay the same or improve.

IAG is benefiting from a higher interest rate environment because a large portion of its investment portfolio is invested in assets that pay interest. With higher interest rates, it's making much bigger returns for this part of the portfolio.

Its profit could also benefit from a shift to the weather pattern of El Nino because that may mean less damaging floods and storms, which obviously hurt profitability when they happen.

In FY24, the business is guiding GWP growth to be in the "low double-digits". The reported insurance margin guidance is between 13.5% to 15.5% and IAG is expecting to deliver an insurance profit of between approximately $1.2 billion to $1.45 billion.

Possible negatives for IAG shares

The broker UBS suggests that while premium repricing "continues to track ahead of claims inflation in most segments and is setting up well for FY25", this is "well anticipated by [the] market, with potential for disappointment if 1H24 does not step up sharply."

UBS also notes the "incremental headwinds in FY24 of perils allowance and reinsurance costs (3 percentage points)".

The broker points out premium prices are increasing significantly but GWP is increasing at a slower rate, which suggests the company has lost volume, "likely due to customers electing higher excesses" as it understands that the retention rate is between 90% to 95%.

IAG share price valuation

UBS currently has a sell rating on the business with a price target of $5.10. That implies it could fall by over 10% over the next year.

Based on the UBS projection for FY24, the IAG share price could be valued at 19 times FY24's estimated earnings with a possible grossed-up dividend yield of 4%.