ASX uranium stock Boss Energy Ltd (ASX: BOE) is in the red today.

Shares in the S&P/ASX 300 Index (ASX: XKO) uranium miner closed yesterday trading for $4.25. In morning trade on Thursday, shares are swapping hands for $4.09, down 3.9%.

For some context, the ASX 300 is up 0.1% at this same time.

Here's what Boss Energy announced this morning.

What's happening with the ASX uranium stock?

The Boss Energy share price is sliding despite the company reporting that it had passed a "key milestone" at its Honeymoon Uranium Project, located in South Australia.

Boss said it had produced production-grade uranium during the pre-flushing of the start-up wells at the site. That keeps the ASX uranium stock on track to fill its Pregnant Leach Solution (PLS) processing ponds by the end of 2023. It also keeps the company on schedule with the overall development timetable at Honeymoon.

"To see production-grade uranium in well pre-flushing augurs extremely well for the start of commissioning and production ramp-up," managing director Duncan Craib said of the result that's failed to boost the ASX uranium stock today.

Atop being on schedule, the project is also within its planned budget.

Craig noted that with the uranium price recently hitting a 15-year high of US$81 a pound, "We are perfectly positioned to capitalise on this huge opportunity."

Craib added:

Our position is further strengthened by the fact that we have no debt, cash on hand of $63 million and a strategic uranium stockpile now worth $1.56 billion based on current spot prices, representing a book profit of more than $100 million since acquisition in March 2021.

The goal at the Honeymoon Uranium Project is to fill the PLS pond in 2023 to prepare for commissioning the IX circuit in January with the first drum of uranium to be produced as planned in the first quarter of 2024, as planned.

The ASX uranium stocks reported that the first set of NIMCIX loading and elution columns for its new Ion Exchange (IX) circuit has been installed. And the electrical and piping works are close to finished.

According to the release, the IX technology "will enable highly efficient capture, concentration and purification of the uranium from the wellfields".

Boss Energy share price snapshot

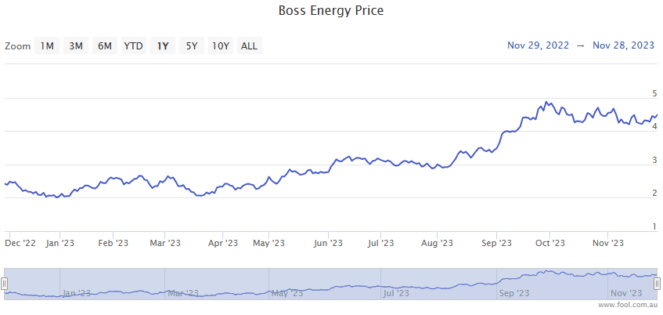

Despite today's dip, the Boss Energy share price remains a standout performer in 2023.

Year to date, shares in the ASX uranium stock are up 101%.