ASX 200 healthcare stock Fisher & Paykel Healthcare Corporation Ltd (ASX: FPH) is outshining all other shares within the benchmark index today.

Fisher & Paykel shares roared to an intraday high of $23.23 shortly after the market open, up 12.9%.

This follows the company's release of its 1H FY24 results, which reveal a 12% increase in profit.

The healthcare stock has since settled back to $22.13 per share at the time of writing, up 7.5%.

Fisher & Paykel is currently the top-performing stock of the ASX 200 today.

Let's review the numbers.

ASX 200 healthcare stock leading the index today

For the six months ended 30 September 2023:

- 12% rise in net profit after tax (NPAT) to NZ$107.3 million, up 22% in constant currency (cc)

- 16% increase in operating revenue to NZ$803.7 million, up 16% cc

- Investment in R&D was 12% of revenue, or NZ$96.9 million

- Interim dividend of 18 NZ cents per share, up 3%, payable 18 December

What else happened in 1H FY24?

Managing director and CEO Lewis Gradon said the first half results indicated a continuation of stable ordering patterns in the hospital business and a robust performance in home care.

In the hospital product group, which includes humidification products used in respiratory, acute, and

surgical care, revenue was $487.5 million, up 11% on 1H FY23 and up 11% in constant currency.

In the home care product group, which includes treatments for obstructive sleep apnea (OSA), revenue was $314.4 million. That's up 26% on 1H FY23 and up 25% in constant currency.

What did Fisher & Paykel management say?

Gradon said the gross margin came in at 60.5%.

That's up 65 basis points on 1H FY23 or 192 basis points in constant currency.

The CEO commented:

Headwinds such as freight rates and manufacturing inefficiencies continue to ease, while inflationary raw material and manufacturing costs remain key areas of focus for our teams.

We remain confident in our ability to return to our long-term target of 65% within three to four years.

What's next for Fisher & Paykel?

The company expects operating revenue for the full year to come in at approximately NZ$1.7 billion.

It is guiding NPAT in the range of approximately NZ$250 million to NZ$260 million.

In terms of specific products, Gradon said the Evora Full was attracting "impressive demand and positive customer feedback" after its first year in the US market.

Next year, the new F&P Solo mask will be rolled out beyond New Zealand and Australia.

ASX 200 stock snapshot

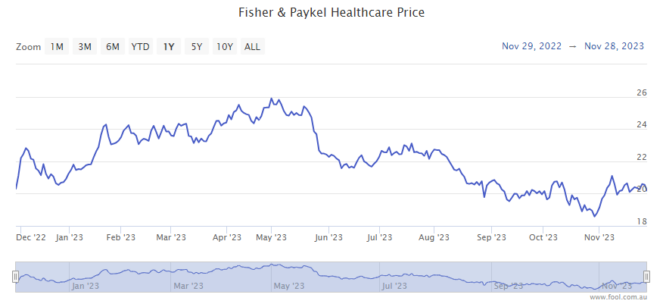

The Fisher & Paykel share price is up 3.75% in the year to date.

That means it is outperforming its peers among ASX 200 healthcare stocks, with the S&P/ASX 200 Health Care Index (ASX: XHJ) declining 5.3% over the same period.

Meantime, the S&P/ASX 200 Index (ASX: XJO) has gone up by 1.5%.