The Core Lithium Ltd (ASX: CXO) share price hit a new two-year low of 32.5 cents on Tuesday.

Core Lithium shares have taken a nosedive in 2023, down 67% in the year to date.

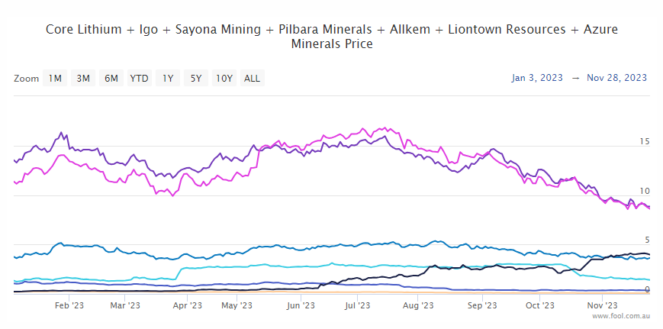

Of course, the stock is not alone.

Many ASX lithium shares have declined this year on the back of a devastating spiral in lithium commodity prices due to various supply and demand factors.

Take a look at this snapshot.

It seems the only thing keeping some stocks elevated this year has been excitement over takeover offers for junior players, such as Azure Minerals Ltd (ASX: AZS) and Liontown Resources Ltd (ASX: LTR).

Besides Pilbara Minerals Ltd (ASX: PLS), they're the only two in this group that are in the green for 2023.

Why has the Core Lithium share price hit a 2-year low?

As mentioned, falling lithium commodity prices are weighing on all ASX lithium shares this year.

A new note from top broker Goldman Sachs documents the major decline from 2022 levels.

It notes a 71.5% decline in the lithium carbonate spot price to US$17,076 per tonne (p/t). The lithium hydroxide price is US$14,663 p/t, down 78.3%; and the spodumene 6% price is US$1,580 p/t, down 64%.

As my Fool colleague James reports, Goldman expects lithium prices will not bottom til 2025.

Next year, Goldman forecasts the lithium carbonate price to fall to US$13,377 p/t, the lithium hydroxide price to fall to US$14,263 p/t, and the spodumene 6% price to fall to US$1,250 p/t.

But in terms of the Core Lithium share price specifically, Goldman says falling lithium prices are likely to have greater impacts.

Another capital raising?

As my Fool colleague James reports, the broker thinks the junior miner is likely to need another capital raise to help it deal with rising costs due to inflation.

Goldman explains:

Given the more rapidly declining lithium pricing environment than we expected when we upgraded the stock to Neutral in Aug, we now see increased risk that funding from existing cash/operating cash flows may be insufficient to fund BP33 development (which may be required to continue spodumene production as Grants pit production ends; FID targeted Mar-24 quarter), particularly with recent underground cost escalations, where, since the DFS in Jul-21, we estimate underground mining costs are up ~40% (on our bottom-up quarterly analysis of >30 listed Australian gold assets).

Goldman has placed a sell rating on Core Lithium with a reduced share price target of 31 cents.

The broker says:

With a [-16%] TSR vs. our covered lithium peer average of +5%, we downgrade CXO to a relative Sell on valuation, where we note that since the start of Sep-23, CXO is down <10%, vs. spodumene down ~40%, and Australian lithium peers down ~25-40%. We sit below Visible Alpha consensus in FY24/25E on our weaker lithium pricing outlook and Finniss ramp up profile.