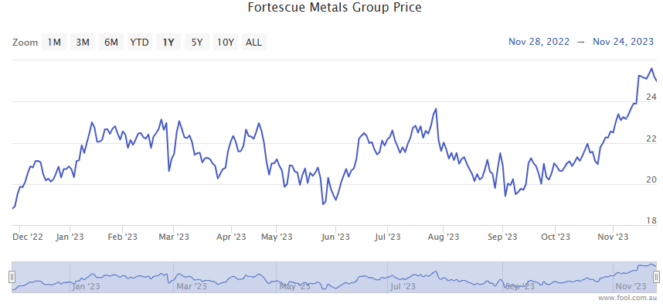

The Fortescue Metals Group Ltd (ASX: FMG) share price has raced ahead of the gains posted by its S&P/ASX 200 Index (ASX: XJO) mining rivals in 2023.

Since the opening bell on 3 January, Fortescue shares have gained 21%. That compares to a 3% year to date gain for BHP Group Ltd (ASX: BHP) shares and a 9% increase in the Rio Tinto Ltd (ASX: RIO) share price.

Investor enthusiasm has, in part, been spurred by the miner's green arm, Fortescue Future Industries.

But that enthusiasm, and the Fortescue share price, could get dampened should Donald Trump regain the presidency of the United States.

Andrew Forrest's green energy vision

Last week, 21 November, Fortescue reported it had approved a Final Investment Decision (FID) on three green projects. That includes its Phoenix Hydrogen Hub, located in the US state of Arizona.

The Fortescue share price closed up 0.7% on the day.

Green hydrogen, if you're not familiar, is produced by splitting oxygen atoms from hydrogen atoms in water using sustainable energy sources.

Fortescue said the Phoenix Hydrogen Hub will have an annual production capacity of up to 11,000 tonnes of liquid green hydrogen. The total investment comes out to US$550 million (AU$835 million). Fortescue is aiming for first production in 2026. But that may be two years into a Trump presidency.

"The Phoenix Hydrogen Hub establishes Fortescue in one of the most attractive energy markets in the world, facilitated by the Inflation Reduction Act [IRA]," Fortescue Energy CEO Mark Hutchinson said.

Fortescue founder Andrew Forrest has been a vocal advocate of the IRA.

And for good reason. The IRA could save billions of dollars in development costs, offering some heady tailwinds for the Fortescue share price.

The landmark climate bill, signed into law by President Joe Biden, provides a whopping US$369 billion (AU$561 billion) in subsidies and tax breaks for approved clean energy projects.

Lauding the potential of the IRA back in March, Forrest said (courtesy of The Australian Financial Review):

You now have to allocate capital where it's most competitive. And that means we have to allocate capital away from Australia into North America.

We have to service our projects in Brazil, Norway, Africa, all over the world, most likely from manufacturing centres now in North America, because they're going to pick up 50% of the capital cost.

Because of the IRA, if I have a project which is going to cost $2 billion in Australia, that's going to cost me $1 billion because they will fund half of it.

But those billions of dollars in funding may well be at risk if Donald Trump moves back into the White House.

Why Donald Trump could upset the Fortescue share price

When you think of sovereign risk the US might not be the first country to come to mind.

Nonetheless, every new presidential election comes with the potential to see new laws enacted and old ones gutted.

Presenting a potential upcoming blow to the Fortescue share price, Donald Trump has made it clear that repealing the IRA would be among his priorities if re-elected.

"On the first day of a second Trump administration, the president has committed to rolling back every single one of Joe Biden's job-killing, industry-killing regulations," said Trump adviser Carla Sands (quoted by the AFR).

Now, Trump won't be able to gut the IRA on his own. That will need Congressional approval.

But should that happen, it could add billions of dollars to Fortescue's US green project development costs, throwing up headwinds for the Fortescue share price.