ASX shares are still waiting for a big push to get the Christmas Rally going.

Let's check out the potential catalysts this week that could drive stocks either way, according to eToro market analyst Josh Gilbert:

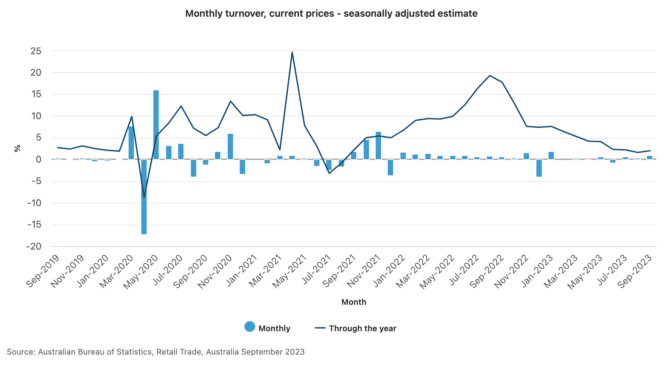

1. Australia retail sales figures

On Tuesday, the latest statistics on how the retail sector is going will be revealed.

Activity in that industry is a "key data point" for the Reserve Bank of Australia in deciding what to do with interest rates, according to Gilbert.

The dilemma for Australia this year has been that surveys have shown pessimism among consumers, but sales have kept holding up.

"With retail spending still high, the fear is that this will continue to feed inflation, the very challenge the RBA is trying to combat."

If this week's numbers show Australian households continuing to spend strongly, it will force the Reserve Bank to impose yet another rate hike in December.

Gilbert is hopeful this won't be the case.

"This week's figures may show the signs of a spending slowdown, with a contraction of 0.3% expected," he said.

"This will be a step in the right direction and good news locally."

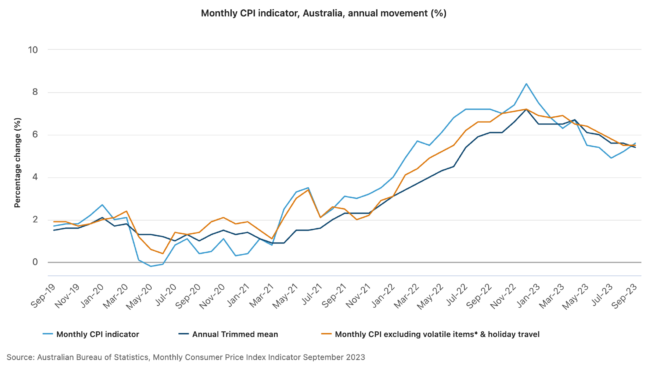

2. Australia monthly inflation

Reserve Bank governor Michele Bullock last week flagged how she is concerned that inflation in Australia is largely generated within the country.

Wednesday's monthly consumer price index update will show whether this is persisting.

"The good news is that the CPI indicator is expected to ease next week to 5.3% from 5.6% in September," said Gilbert.

"This is a welcome prediction for many, given other deciding factors, such as unemployment and retail sales, remain stubborn."

The trouble for Australia has been that the Reserve Bank has been less aggressive with rate hikes than other comparable nations.

"Whilst other central banks are ending their tightening cycles, Australia seems far from a conclusion. The key for other nations has been higher interest rates," Gilbert said.

"The Bank of England sits at 5.25%, and the [US] Fed sits at 5.25% to 5.5%, both just under 100 basis points higher than the RBA's cash rate."

3. Black Friday and Cyber Monday

The American tradition of Black Friday seems to have well and truly permeated Australian society.

Gilbert reminded investors that the phenomenon doesn't just end after one day, with Cyber Monday following a couple of days later.

"According to retail groups, the annual sales event is set to eclipse the once-unbeatable Boxing Day sales phenomenon.

"With consumer habits now well and truly adjusted to go all-in on a late November splurge, retailers now see little choice but to participate or risk missing out on one of the biggest consumer events of the year."

The frenzy won't be showing up in this week's retail sales numbers, but Gilbert is worried it could significantly push up December numbers.

"[It's] something that may well be a key factor in driving ongoing rate rises into the new year."