When the term passive income is mentioned, many investors think of dividends.

That's fair enough. The turbulence in financial markets and the world in general the past couple of years has sent many investors sheltering under the cover of ASX dividend stocks, looking for reliable returns.

However, capital growth can just as easily be passive income.

And if a stock returns both dividends and capital growth, all the better!

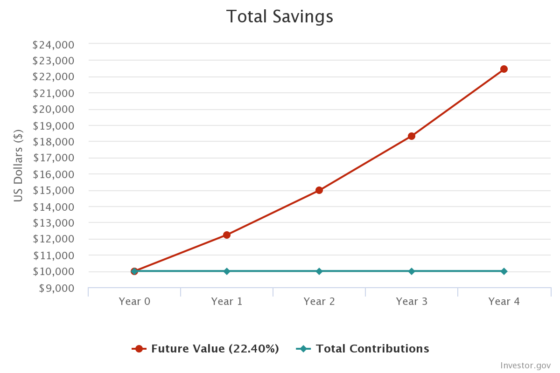

Such an investment can easily turn $10,000 of your savings into $12,000 of passive income in quick time.

Let's take a look at a hypothetical:

Growth and dividends? It's possible

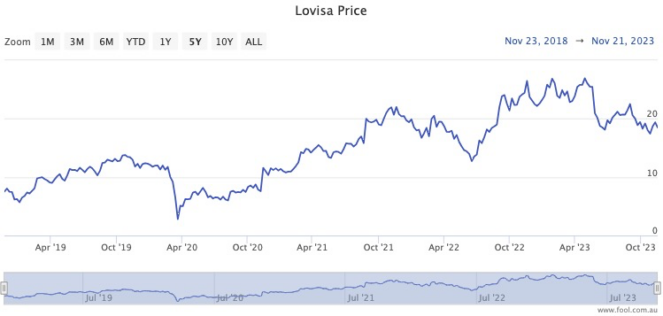

Budget jewellery retailer Lovisa Holdings Ltd (ASX: LOV) is an excellent example of a stock that boasts both growth potential and decent dividend yield.

Over the past five years, the Lovisa share price has rocketed a stunning 135%. Meanwhile, it's paying out a chunky 3.8% yield, which is 70% franked.

Although the past is not an indicator of future performance, we can use these numbers to demonstrate the killer potential of capital growth stacked on top of dividend income.

Just on capital growth, the compound annual growth rate (CAGR) works out to be 18.6%. If dividends are immediately reinvested to buy more shares, that is elevated to 22.4%.

This means that an initial $10,000 investment will have turned into $22,445 in just four years.

That there, is $12,445 of passive income.

How good is that? You made that much money after only putting in $10,000.

Still plenty to come for Lovisa

For the record, Lovisa shares are still highly recommended by many professional investors.

According to CMC Markets, nine out of 14 analysts reckon it's not too late to buy the stock, recommending it as a current buy.

On Wednesday, the retailer revealed that its store count increased by a net 35 stores in the first 20 weeks of its 2024 financial year.

"Compared to this time last year, Lovisa is currently trading from 160 more stores and it's operating in 14 additional markets," reported The Motley Fool's Tristan Harrison.

"Lovisa revealed it's expecting to open its first stores in Vietnam and mainland China over the coming month."