It can be a promising sign when company insiders or directors decide to invest in their own S&P/ASX 300 Index (ASX: XKO) shares.

Certainly, investors may be worried when an insider sells their shares – is there bad news coming? There can be legitimate reasons for selling down shares though, such as buying properties or for tax purposes.

However, there may be only one reason for a director's investment– they think it's good value. With that in mind, let's look at three ASX 300 shares where insiders recently invested.

Challenger Ltd (ASX: CGF)

Challenger is the leading provider of annuities in Australia. It also has a large funds management segment. As we can see on the chart below, the Challenger share price is down around 22% in 2023 to date.

It was recently announced that director Duncan West had made an on-market trade to buy 17,500 Challenger shares at a cost of $5.86 per share. That's a total cost of $102,550.

This ASX 300 share investment was made on 16 November 2023, and the Challenger share price is currently trading slightly lower than it was at that time.

APM Human Services International Ltd (ASX: APM)

APM operates in 11 countries, including Australia, the UK, Canada, the US, and Germany. Each year, it supports more than two million people of all ages through its service offerings which include medical assessments, allied health and psychological intervention, psycho-social and vocational rehabilitation, vocational training and employment assistance, and community-based support services.

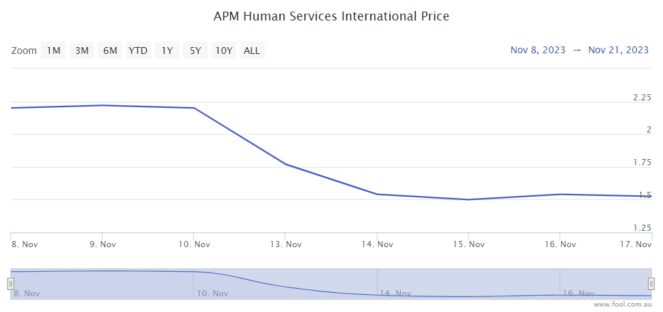

The APM share price is down 31% since 9 November 2023 after an update at the company's annual general meeting (AGM), as we can see on the chart below.

Executive chair and founder Megan Wynne recently made huge investments to buy some more APM shares. On 15 November, she bought 1.5 million shares for $2.26 million and on 16 November, she bought 1.1 million shares for almost $1.7 million. These were huge votes of confidence in the ASX 300 share.

Ramsay Health Care Ltd (ASX: RHC)

Ramsay is one of the largest private hospital operators in Australia and Europe. The ASX 300 share has suffered following the COVID-19 pandemic, aside from a brief period of takeover excitement.

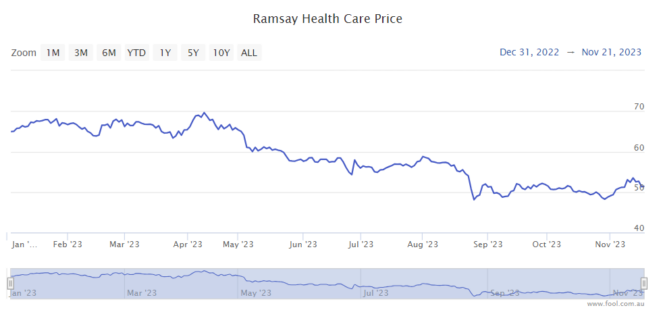

Since the start of 2023, the Ramsay share price has fallen by 22%, as we can see on the chart below.

On 15 November, director Karen Penrose bought 665 Ramsay shares for a price of $52.59 each (costing around $35,000) and then on 20 November, Penrose acquired another 195 Ramsay shares for $50.95 each (costing around $10,000).