The Azure Minerals Ltd (ASX: AZS) share price is slightly higher on Friday amid a major shareholder's assertion that the junior explorer's takeover by a Chilean lithium giant appears unlikely to proceed.

Azure shares are currently trading for $4.03, up 0.25%.

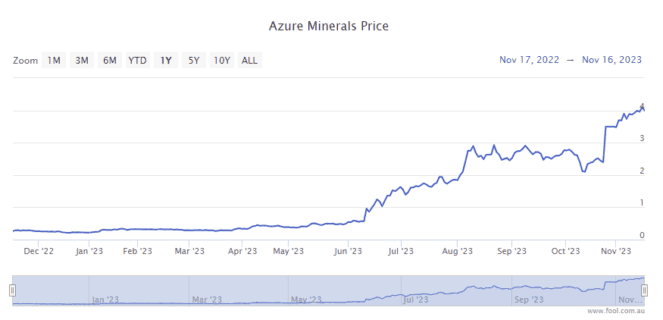

The ASX lithium share has enjoyed a 65% turbocharge since Azure announced a $3.52 per share takeover offer from Sociedad Química y Minera de Chile S.A. (NYSE: SQM) in late October.

Let's see what Ellison had to say.

Azure share price green despite Ellison's comments

As reported in The Australian, Mineral Resources Ltd (ASX: MIN) boss Chris Ellison described the Azure takeover deal as 'dead in the water' yesterday while talking to journalists after the company's annual general meeting.

The ASX 200 mining giant chief said:

From where I'm sitting it looks like it's dead in the water.

If you have a look on the share register, you'll find it's probably about half a dozen different organisations that actually own most of Azure. And I'm not sure if any of those are willing sellers. A couple of them are, maybe. But there's probably three or four in there that are buyers.

Can the Azure takeover still proceed?

There are two parts to the proposed takeover deal from SQM.

The first is a proposed scheme of arrangement whereby SQM acquires 100% of Azure shares and takes over ownership of the company entirely. This deal requires at least 75% of shareholders to agree.

That's very tough to achieve when several individual parties hold large chunks of Azure shares.

In the event that the scheme offer fails to go through, SQM has offered to acquire as many shares as it can from willing shareholders under an off-market takeover deal at $3.50 per share instead.

SQM already owns about 20% of Azure, and if it can get 50.1% acceptance, it would achieve majority ownership. Once again, that may be hard to achieve given the state of the current share register.

The Azure board unanimously recommends the scheme of arrangement, and one major shareholder, Delphi Group, has already committed to supporting the deal unless a superior offer comes along.

Ellison and Rinehart mount strategic buy-ups of Azure shares

A condition of the scheme of arrangement is that no other shareholder acquires a stake higher than 19%.

On the day after Azure revealed the deal, we learned that Gina Rinehart of Hancock Prospecting had quickly amassed an 18.3% stake.

Rinehart had been buying Azure shares since June, but on the day Azure announced the SQM offer, she swooped in and purchased just under $190 million worth of Azure shares. This made her an official 'substantial holder', defined as any individual or company with a 5% or greater stake.

She bought another $21 million parcel of Azure shares the next day to take her total stake to 18.3%.

Ellison did some Azure share swooping of his own.

Mineral Resources had also been buying Azure shares since early October. But he bought a lot more after news of the SQM deal broke. By last Friday, MinRes had amassed a 13.56% stake in Azure.

Rinehart and Ellison have both been buying large stakes in junior lithium explorers of late.

Rinehart bought a 19.9% stake in Liontown Resources Ltd (ASX: LTR) before its proposed takeover by Albemarle Corporation (NYSE: ALB) collapsed.

Meanwhile, Ellison has become the biggest shareholder of Delta Lithium Ltd (ASX: DLI) and recently bought nearly a fifth of Wildcat Resources Ltd (ASX: WC8).

Ellison amassed a total 17.44% stake in Delta back in August. He is now the non-executive chair of the board, with MinRes lithium division CEO Joshua Thurlow also now a director.

Rinehart also owns a chunk of Delta. Mineral Resources is currently underwriting a $70 million capital raising for Delta, with Ellison and Rinehart both set to take up their full entitlements.

As we reported yesterday, one of the key current goals of Mineral Resources is to maximise the potential of its lithium portfolio.