One ASX small-cap stock rocketed 13.8% on Tuesday, but it's not too late to hop on for the ride.

That's the opinion of Shaw and Partners portfolio manager James Gerrish, who noted how Catapult Group International Ltd (ASX: CAT) shares jumped from a "strong" first-half update that ticked many boxes.

"Revenue was up 21% in constant currency terms to US$49.8 million largely on the back of 20.6% growth in annualised contract value (ACV)," he said in his Market Matters newsletter.

"The core wearables business that provides important analytical data about athlete performance continues to grow at a consistently high rate, up 27% in the first half."

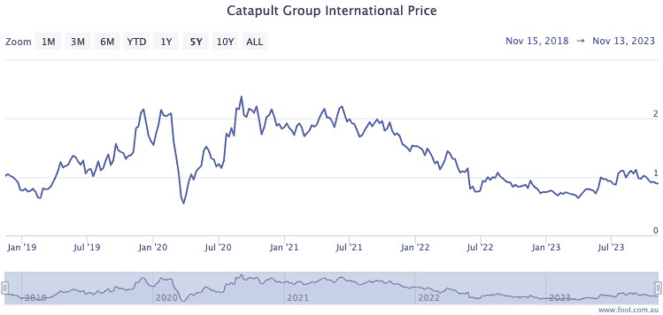

The Catapult share price is now up 44.6% year to date, but is still down almost 53% since August 2020.

Gerrish's team is "long and bullish" on the sports technology provider.

"The two key growth avenues for the company are the video and software products which feed into coaching and management staff decisions and planning.

"Software ACV was up 25% in the half while the new video solution grew 41%."

'Managed to increase revenue and reduce costs'

While this sales momentum is fantastic, there was a different metric that wowed Gerrish's analysts the most.

"The thing that impressed us most was the swing into positive free cash flow (FCF), which improved from -US$13.4 million in 1H23 to +US$1.4 million in the current half," he said.

"Catapult managed to increase revenue and reduce costs."

This latest half-year report was "an inflection point" that could trigger "a significant re-rate" in the stock, according to Catapult chief executive Willians Lopes.

"In our view, the sales growth across the board gives us more confidence in Catapult's product, particularly in video where they have faced technical and integration issues in the past."

Although not widely covered, Gerrish's peers seem to agree with his bullish outlook.

According to CMC Markets, all three analysts that study Catapult currently rate the small cap as a buy.