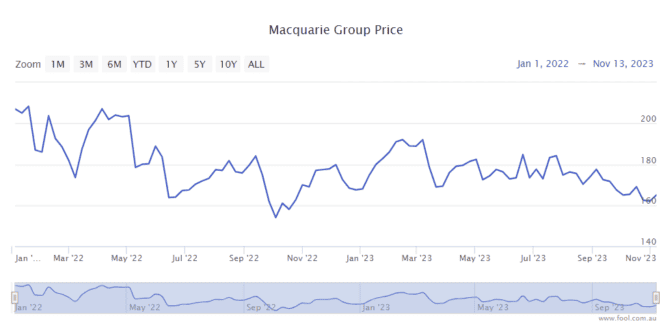

The Macquarie Group Ltd (ASX: MQG) share price has just hit a 52-week low of below $159. The ASX financial share has fallen in tough times, down around 20% since February 2023 and it has dropped 25% from January 2022, as we can see on the chart below.

As I'm sure many readers know, this business operates across several financial sectors, with a presence in banking and financial services (BFS), asset management, investment banking (Macquarie Capital) and commodities and global markets (CGM).

Perhaps unsurprisingly, the business is losing the excitement of investors with the company reporting lower profit, and conditions looking less compelling for the investment bank.

Cons of investing

A business is normally judged on its ability to make profits in the future.

In the FY24 first-half result, it said that net profit after tax (NPAT) was down 39% year over year to $1.4 billion, with international income representing 65% of total income.

Macquarie has done a good job of diversifying its business over the years, but it's still exposed to some volatility and perhaps a victim of its own success – it can't keep posting strong numbers forever if the economic backdrop becomes difficult.

It's possible that profit could fall again if the elevated interest rates make things difficult for arrears in the BFS segment, hurt asset prices in the asset management segment and so on.

Finally, Macquarie has become a huge business, with significant growth since the GFC. The bigger it becomes, the harder it is for the company to keep growing at a strong pace in percentage terms, so I'm not expecting the next 10 years to be as good as the last decade for Macquarie shares.

Positives

Macquarie did say in the HY24 results that the BFS and asset management segments saw growth in the loan book, deposits and assets under management (AUM).

I'd describe quite a few parts of Macquarie's business as cyclical. We've seen strength over the past three years and now there may be a period of weaker performance. The Macquarie share price has dropped to reflect that, but I believe this could mean the business is getting to the point where it could be an opportunistic time to buy.

I don't know how long it will take for conditions to return to positivity and reach a strong point – it could take two years or more. But, I believe it's at times like this – where uncertainty is widespread and the outlook is weak – when ASX financial shares (or any shares) are attractively priced.

The dividend yield also improves when the share price falls. According to projections on Commsec, owners of Macquarie shares could get a grossed-up dividend yield of around 4.6%.

For a long-term, blue-chip-focused investor, it could be a decent time to invest. But, there's a chance it could keep falling from here.

Macquarie share price valuation

Based on the projection on Commsec that the investment bank could generate earnings per share (EPS) of $9.48 in FY24, it's trading on a forward price/earnings (P/E) ratio of 17 times.