There are plenty of cheap shares out there, but the trouble is working out which ones are in a temporary dip and which are in chronic malaise.

Helpfully some experts this week have picked out discounted stocks that are ripe for buying at the moment:

'Confident' about the trajectory of this bargain

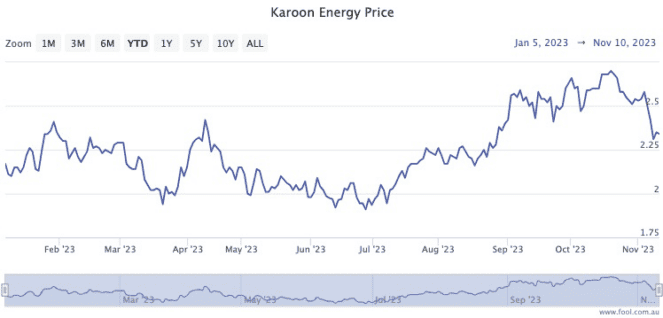

Karoon Energy Ltd (ASX: KAR) shares have tumbled 12.6% since 18 October.

But with energy security a hot topic with wars going on in Europe and Middle East, Morgans investment advisor Jabin Hallihan reckons the stock is buy.

"The oil producer posted a robust 2023 September quarter result. Oil production of 2.85 million barrels was up 69% on the June quarter," Hallihan told The Bull.

He added the business has multiple tailwinds that make it attractive.

"A solid cash balance of US$181.5 million, a disciplined acquisitions approach and a steady Bauna operation contribute to Karoon Energy's appeal.

"We retain an add rating, as we're confident about Karoon Energy's positive trajectory in the energy sector."

'Share price is trading at a discount'

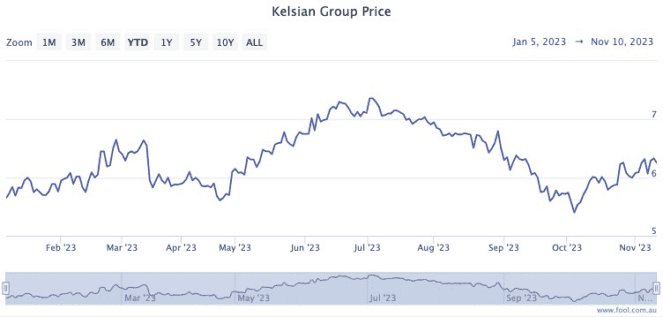

Transport provider Kelsian Group Ltd (ASX: KLS) has seen its stock price drop 38% since April 2021, and more recently 13.4% from 3 July.

Shaw and Partners senior investment advisor Jed Richards is bullish though because of a catalyst.

"The company operates public bus and marine transport services in Australia and abroad.

"The recent acquisition of All Aboard America Holdings gives the company a platform for further growth in the US."

He considers transport to be a service that doesn't easily wane in demand due to economic pressures.

"We believe the share price is trading at a discount considering the defensive and low risk earnings growth on offer."

'One of the cheapest gold names'

The Ramelius Resources Ltd (ASX: RMS) share price has plunged more than 10% over the past three weeks.

However, the fragile geopolitical situation makes the gold miner a buy, as far as Richards is concerned.

"The gold price has rallied recently in response to the war in the Middle East. In volatile times, buy gold."

He added that Ramelius is "one of the cheapest gold names in the sector".

"[It] should generate more growth as its operations at Mt Magnet ramp up. The company says it remains on track to deliver full year guidance."